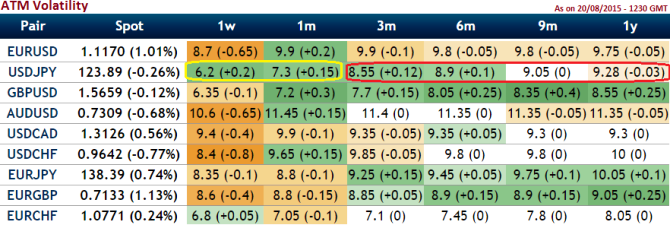

It is observed that the volatility of the 1M-1Y ATM contracts is projected to be creeping higher with global macro manipulations; especially Fed's rate hike is on the agenda. Chinese devaluation did not seem to impact much on Yen, one can make out that from last two days of yen's stability and gains yesterday, if you have to compare this with other Asian pairs then huge difference is seen. Hence, we believe Yen is waiting curiously to get benefitted from any outcome of the rate decision in short run.

Maximum Profit: Unlimited

Technically, the most the long straddle can make to downside is limited to how much the underlying asset can drop, which is limited to a price of $0. In options trading, we label as unlimited profit when this options strategy gains as long as the USDJPY rises.

Maximum Loss: Limited to the extent of net debit paid initially in order to construct this strategy.

Break Even Point: There are 2 break even points to a long straddle. One breakeven point if the USDJPY goes up (Upper Breakeven), and one breakeven point if the pair drops down (Lower Breakeven).

Upper BEP: Strike Price (ATM long calls) + Initial debit

Lower BEP: Strike Price (ATM long puts) - Initial debit.

FxWirePro: USD/JPY straddles well placed on rising 1ATM vols – Risk/Reward and Breakeven profile

Friday, August 21, 2015 6:48 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand