USDTRY has resumed its bullish streaks with the current price at 5.6909 levels, the major uptrend of this pair bounce back at 9EMA support after 3-black crow pattern.

Most noticeably, the Turkish lira experienced volatility again late last week: on Thursday the exchange rate rallied sharply in a move reminiscent of days when policymakers had intervened in the London swap market by reducing lira supply.

But, the rally did not last long – on Friday, the exchange rate returned to its weakening ways. The exact trigger is difficult to pinpoint: it could have been President Erdogan’s announcement that Russian S400 deliveries were likely to begin in July – this may have prompted fears that the US administration could impose sanctions.

Such exact triggers can only be discussed ex-post – in general, most market participants know fully well that Turkey occupies a complex geopolitical position – it makes no sense to be surprised by individual announcements which simply reflect that reality from time to time. The relevant conclusion for the FX market is that the recent swap market interventions have not ‘shocked’ or ‘disciplined’ the market in a manner that the lira’s medium-term depreciation trend has gone away.

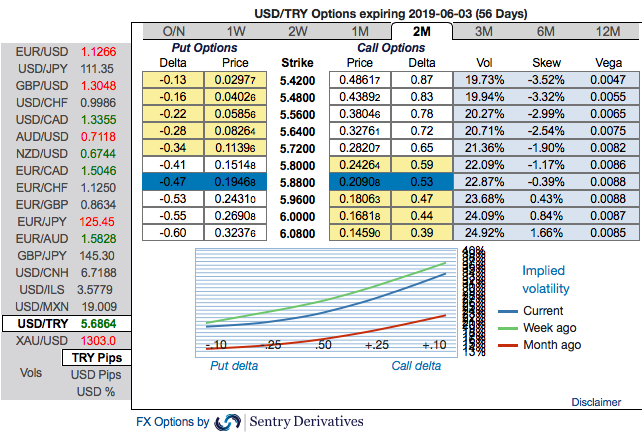

Trade tips: 3m USDTRY debit call spreads are advocated with a view to arresting upside risks. Initiate 3m 5.30/6.54 call spreads at net debit. Thereby, one achieves hedging objective as the deep in the money call option with a very strong delta will move in tandem with the underlying spikes.

The rationale for the trading: Please observe that the above technical chart is also clearly indicating the further upside risks.

It seems that hedgers of TRY are interested in bullish risks as the positively skewed IVs indicate bids for the OTM calls with the above fundamental factors.

IVs of this underlying pair is on the higher side, trending highest among the G20 FX space. Call options with a higher IVs cost more, because, increasing IV is desirable for the holder of the option, just for the intuition that the higher likelihood of the market ‘swinging’ in holder’s favor. Please also be noted short-dated options are less sensitive to IV, while long-dated is more sensitive. Courtesy: Sentry & Tradingview.com

Currency Strength Index: FxWirePro's hourly USD spot index is flashing -47 (which is bearish), at press time 13:13 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data