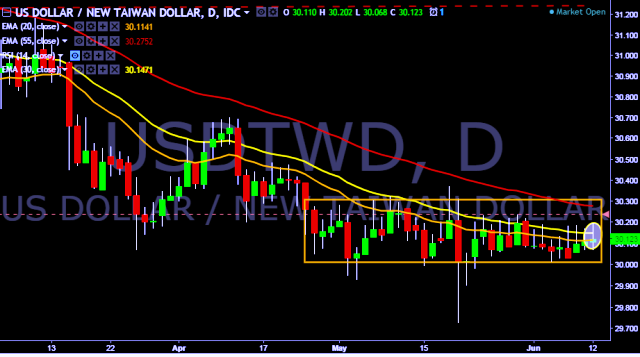

- USD/TWD is currently trading around 30.12 marks.

- It made intraday high at 30.20 and low at 30.06 marks.

- Intraday bias remains neutral for the moment.

- A daily close above 30.20 will drag the parity up towards key resistances around 30.48, 30.69, 30.90, 31.02, 31.15, 31.26, 31.78, 31.98, 32.12, 32.25, 32.43 and 32.63 marks respectively.

- On the other side, key support levels are seen at 30.00, 29.90, 29.84, 29.72, 29.61 and 29.28 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- Taiwan stocks open down 0.6 pct at 10,137.04 points.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.