The market is currently seeing the likelihood of three Fed rate hikes until late 2017 as standing at 50% – the highest level since the FOMC meeting in March. At the time the market was still convinced that there would be a further two rate steps until end-2016. Now we know that there will be only one more this year. The same 2017 likelihood as in March, therefore, has a completely new quality.

It signals market expectations of a much faster Fed rate hike cycle. Hardly surprising as the 5Y×5Y inflation expectations (i.e. the market bet on average US inflation rates for the period of 2021/26) has reached new highs.

The FX Markets began pricing in owing to a Trump’s victory after the Republican candidate took the lead over the democrat. The U.S. dollar managed to bounce back vigorously after the US Election Day from the slumps of 1.3264 to the current 1.3496 levels during mid-European sessions.

The election of Donald Trump as the next US president saw the initial “risk-off” move properly trumped, as his acceptance speech was more conciliatory and the focus moved towards his fiscal policies. US equities, particularly the S&P500, flew back towards all-time highs, while the US yield curve steepened, led by 10-year yields racing up through 2%. This lent renewed support to the USD, especially versus G10.

On the flip side, the oil driven currency gaining upside traction ahead of OPEC’s meet that is scheduled on Nov 30th to coordinate a cut, potentially together with non-OPEC member Russia. OPEC may probably extend a proposition to other producers curtail their oil production by 880,000 barrels per day for six months starting from Jan. 1 2017, sources stated.

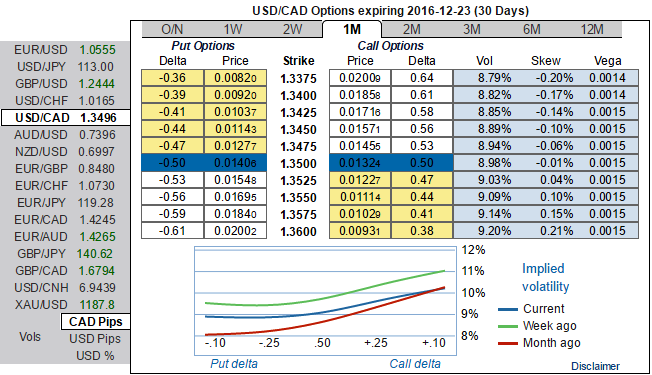

The implied volatilities of 1W USDCAD ATM contracts are trading 9.15%, while 1m IVs are just shy above 9%.

While these 1m IV skews are supportive of OTM call strikes, the premiums of 1W ATM contracts are trading at 14.75% more than NPV which is disparity between IVs and option pricing amid uptrend of the underlying spot FX, hence, comparing this disparity with bullish neutral risk reversals we think the opportunity lies in writing an OTM put while formulating below option strategy for USDCAD hedging.

Hedging Framework:

3-Way Options straddle versus OTM put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Fed’s hiking speculation is the major booster for the dollar while crude price gains cushion CAD on the contrary, in this scenario eyeing on OTC price differentials to keep FX exposures optimally hedged.

How to execute:

Go long in USDCAD 1M at the money +0.51 delta call, go long 1M at the money -0.49 delta put and simultaneously, short 1w (1%) out of the money put with positive theta.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic