EURSEK is unchanged over the past month, albeit once again the cross briefly flirted with the upper end of the six-year range at 9.60-9.70.

We expect continued range-trading through until year-end and then only very modest appreciation from SEK through next year (9.35 by end-16 and 9.15 by Q3’17).

The catalyst for a major break higher in SEK is lacking – a definitive end to the Riksbank easing cycle and a tangible prospect of rate hikes within a 6-9 month time frame.

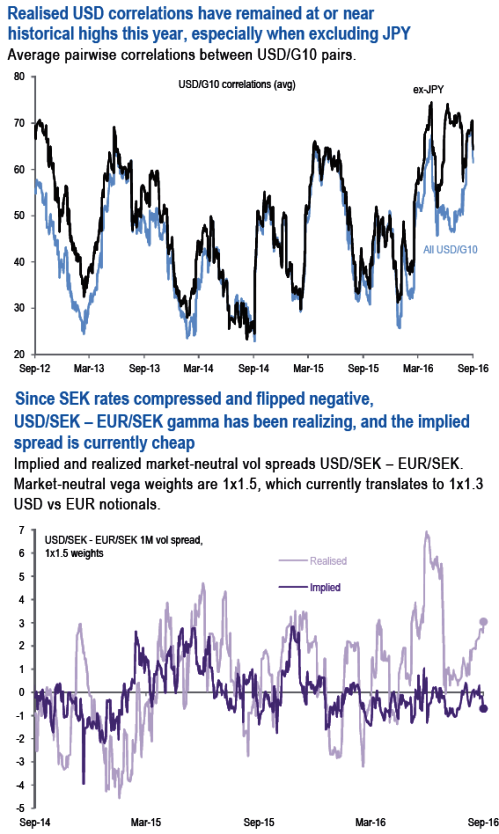

In the case of SEK, long positions in USD vols can be advantageously coupled with short vols in the EUR cross.

Long gone are the days when the market was testing the Riksbank’s nerves in the low 9.0s in EURSEK. The latest Swedish data do point to a rebound from slowing economic momentum.

However, this did very little to improve sentiment and lift SEK, as the undershoot in the country’s Economic Activity Surprise Index (EASI) is second only to NZD among the pairs we track .

With the market looking for negative rates to extend to Q3 2019 – a good 1y past the Riksbank’s forward guidance, it is unlikely that SEK attracts significant inflows, and “we expect continued (EURSEK) range-trading through until year-end”. This range-bound outlook on EURSEK – which the price action around German.

Financials woe doesn’t question, should play its part in keeping USD correlations at historically firm levels, especially when removing the BoJ-led effect of JPY. It is, therefore, supportive of a USDSEK vs EURSEK vol spread trade.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes