GBP fell further than expected in the aftermath of the UK vote to leave the EU and after the MPC eased policy at the start of August.

Since then, a bounce in economic indicators has been accompanied by a GBP bounce to levels where fresh shorts, vs EUR, are attractive.

The UK produces upbeat numbers:

Service PMIs – actual 52.9 versus previous 47.4 and forecasts were at 49.1;

Construction PMIs – actual 49.2 versus previous 45.9 and forecasts were at 46.6;

Manufacturing PMIs – actual 53.3 versus previous 48.3 and forecasts were at 49.1.

Despite these indications, the UK economy was slowing before the referendum and the additional uncertainty from the vote will only exacerbate that downtrend. On the other hand, BOE stays pat in its monetary policy hinting on the further easing cycle in upcoming meetings.

The initial weakness of (mostly) survey data pointed to an economic hit but overstated the near-term magnitude. The better recent data confirms the sky didn't fall, but a long period of corrosive economic uncertainty still lies ahead.

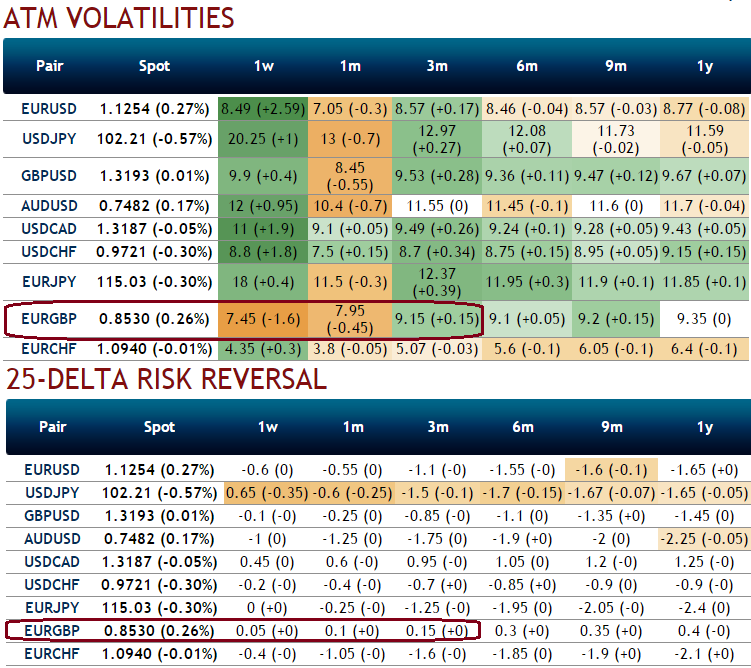

As shown in the above nutshell, 3m IVs and risk reversals seem comparatively attractive bid over 1m tenors. 1w IVs are collapsed below 7.5%, and risk reversal indicates no significant upside risk in this period, as a result, we ponder over shorting an ITM call option while holding long term calls to hedge upside risks.

Hence, we recommend initiating longs in 2 lots of 1M ATM +0.51 delta call, and simultaneously short 1 lot of ITM call (1%) 1w expiry in the ratio of 2:1.

So, trading option spreads in different strikes allows the traders in many tricky market scenarios and likely to fetch positive cash flows.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts