Although the March meeting ended last week a roughly 1:4 shot for a hike, a range of FOMC members and the Chair herself pushed it to fully priced by this Thursday.

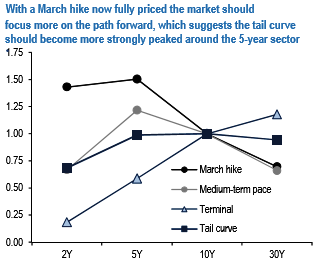

With March fully priced, markets should turn to focus on the path of hikes which argues for taking profits on longs in 3 versus 10-year tails and replacing them with longs in 5-versus 30-year tails.

FF/LIBOR spreads narrowed sharply in the spot and forward space, likely driven primarily by supply technicals and abundant cash in the front end.

Unsurprisingly, the upper left of the implied volatility surface was bid this week as the market rather dramatically re-priced near-term Fed expectations.

The tail curve was notably flatter since we last published, with 3-month volatility on 2-yar tails up 1.4 abp, while 5s were roughly unchanged and 10-and 30-year tails were down 2.1 and 3.5 abp, respectively.

The bottom right of the grid outperformed on light volatility supply, with most long-dated structures in 20-and 30-year tails unchanged to down small as of Friday’s close.

The above chart illustrates the volatility relative to 10-year tails assuming next hike odds, the near-term path of hikes, or terminal Fed funds are the primary drivers* of daily price action relative to the tail curve as of 3/3/17; unitless.

Based on the partial beta of daily changes with respective to 3/15/17x1M OIS rates, Z7/Z8x1M OIS curve slope, and 5Yx5Y OIS rates. Based on a 3-month regression of daily changes in each swap rate versus the same in these factors.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says