The oil section of the midyear Commodities outlook called for an acceleration in global stock draws as we progress through the third quarter. This week’s US EIA data offer some evidence that this is starting to happen.

However, with US crude stocks still c.100 mb above the five-year average (roughly equal to a surplus of 25%), the pace of adjustment needs to accelerate if our price forecasts are for 3Q’17 are to be realized. Pivotal to the current price forecast of $50/bbl for Brent in 3Q’17 is the assumption that OPEC’s production restraint will, in the short term, remove some, but not all of the excess inventories present in the market.

Conversely, oil prices will need to ration US shale growth as the marginal source of non-OPEC production, and despite the recent slowing of US rig count growth.

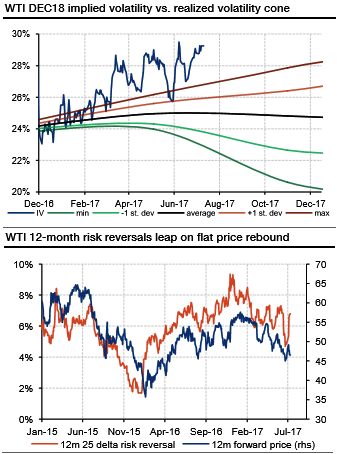

Crude oil implied volatilities moved moderately higher in the recent past, the term structure of implied volatility shifting upwards by approximately 1% for both Brent and WTI options. 12-month at-the-money implied volatility on WTI is now above 30%, the highest level since the December 2016 OPEC meeting.

Meanwhile, ATM IV levels on WTI JUN18 options are currently trending higher above 31%, moderately higher than the levels recorded on the DEC18 contract.

Compared to realized volatilities, long-dated WTI and Brent options seem expensive. The topmost chart plots WTI ATM implied volatilities for options written on the DEC18 contract, alongside with the historically realized volatility cone.

Volatility cones are shown to compare implied volatility levels with realized volatility sampled over time periods corresponding to the remaining time to maturity of the options. At 29.25%, ATM DEC18 implied volatility is currently 5 percentage points above the average 18-month realized volatility (black line). Sources: Soc.Gen.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed