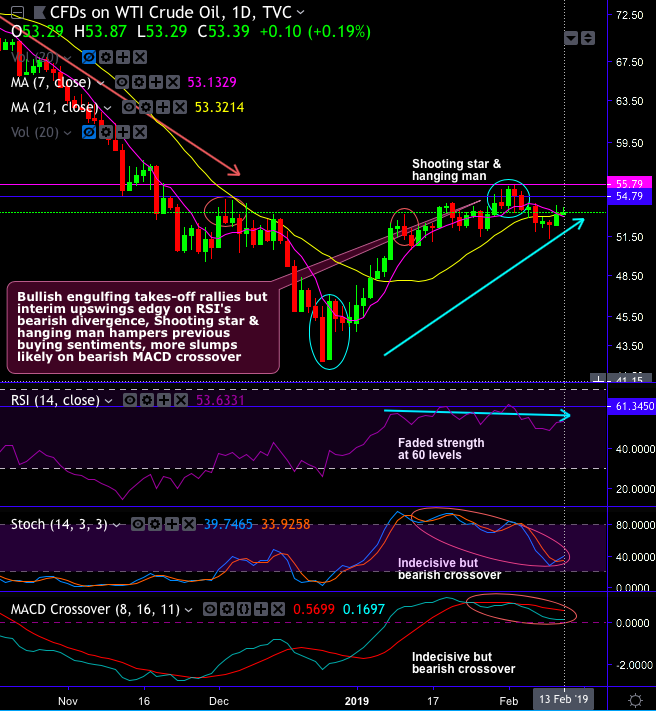

Technical Glance: On WTI crude daily chart, the recent rallies have bounced above 7DMAs upon the formation of bullish engulfing pattern at $46.57 levels but were restrained below stiff resistance zone of $54.79 - $55.79 levels as shooting star and hanging man pop up at this juncture that indicates weakness (refer daily chart).

As a result, the minor uptrend now seems to have been exhausted as RSI has also been showing divergence which is a bearish indication. For now, more slumps seem to be likely on bearish MACD crossover.

While on a broader perspective, Please be noted that on monthly terms, steep slumps are observed well below EMAs as the formation of 3-black crow patterns is completed at $45.40 levels, ever since the failure swings at stiff resistance of $76.29 levels, bears have managed to constantly nudge prices below EMAs and retrace more than 61.8% Fibonacci levels are observed.

Hammer has occurred at $53.98 levels, although we could see some abrupt rallies in last month, both the leading & lagging indicators still signal weakness (refer monthly plotting).

For now, more weakness is foreseen on this timeframe, as well as both leading oscillators (RSI & stochastic curves) indicate faded strength in the previous consolidation phase and intensified selling momentum in the current bearish trend. While lagging indicators (EMA & MACD crossovers) also signal downtrend continuation.

Overall, hammer at $53.98 levels may have shown the rallies above DMAs, but the major trend still remains edgy.

Trading Recommendations: The OPEC and EIA report today are most likely to provide fresh impetus for crude oil’s directional move. The production monthly report published last week reported an increase in US crude production by 1.8mbd YoY and 345kbd MoM.

On daily trading grounds, at spot reference: $53.36 levels, we advocate constructing tunnel spread ahead of EIA inventory check, using upper strikes at $54.79 and lower strikes at $52.28 levels. The strategy is likely to fetch leveraged yields as long as the underlying price keeps dipping but remains above lower strikes on the expiration.

Currency Strength Index: FxWirePro's hourly EUR is at -85 (bearish), while USD is inching at 104 (which is bullish), at press time 13:34 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios