Crude oil prices are stabilized somewhat after a strong rise through most of February. WTI has spiked about 5.3%, while Brent crude has risen 8.22% so far, as compared with January.

US EIA reported its latest inventory levels last night, crude oil production reached 12 million barrels per day (mbpd) for the first time last week. Crude oil output has dipped to -8.6 mbpd from previous 3.7 mbpd, while consensus was about 2.8 mbpd.

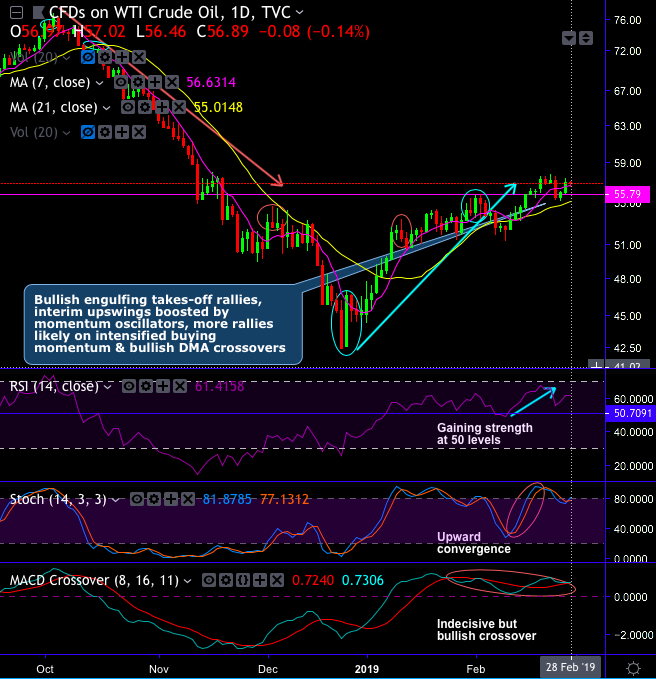

Technical and Candlestick Patterns: WTI crude prices have been spiking higher in the recent past to hit 3-months’ highs ($57.79 levels).

Bullish engulfing takes-off rallies, interim upswings boosted by momentum oscillators, more rallies likely on bullish DMA crossovers (refer daily chart). Both leading oscillators (RSI and Stochastic curves) are showing upward convergence to the prevailing rallies but overbought pressures, however, indicates the intensified buying momentum.

On a medium-term perspective, sharp rallies have been observed after bottoming out at $42.40 levels. The interim upswings for now, likely to drag further but to restrain below 7EMAs.

Nevertheless, the major downtrend continuation also seems to be on cards as both technical indicators signal weakness. The consolidation phase took place upon hammer & dragonfly doji formations at $33.73 and $33.87 levels but 3-black crow pattern has occurred at $45.40 levels to counter with steep slumps below EMAs (refer monthly chart).

Overall, one could foresee topsy-turvy swings the major trend of this energy commodity in 2019.

Demand/Supply Equation: The Venezuelan crisis and Russia fulfilling its OPEC+ agreement have been offset by President Trump tweeting that 'oil prices are getting too high' and 'OPEC should relax'.

OPEC likely to keep curbing its production through H2’2019, Saudi Arabia’s oil minister stated on Wednesday, shrugging-off the Trump’s objections in the administration to stimulating oil.

A troop of 14 oil producers from the OPEC and 10 league nations, led by Russia, entered into a pact to carry out the curbs. This move has caused almost 25% spike in crude prices, which in turn caused apprehensions of President Trump as he perceives this as a threat to the global economy.

Trading Recommendations: Contemplating above both technical and fundamental rationale, anybody on this planet can guess this rationale that when supply decreases with the increasing demand is forecasted, then the price of the commodity tends to shoot up. Hence, we’ve already advocated initiating longs in NYMEX WTI June 2019 and short NYMEX WTI December 2019 spread on hedging grounds at - $1.19/bbl in the recent past, with the target of +$2/bbl and stop loss of -$2/bbl. Courtesy: TradingView.com and JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 4 levels (which is neutral), while hourly USD spot index was at 42 (bullish) while articulating (at 13:57 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts