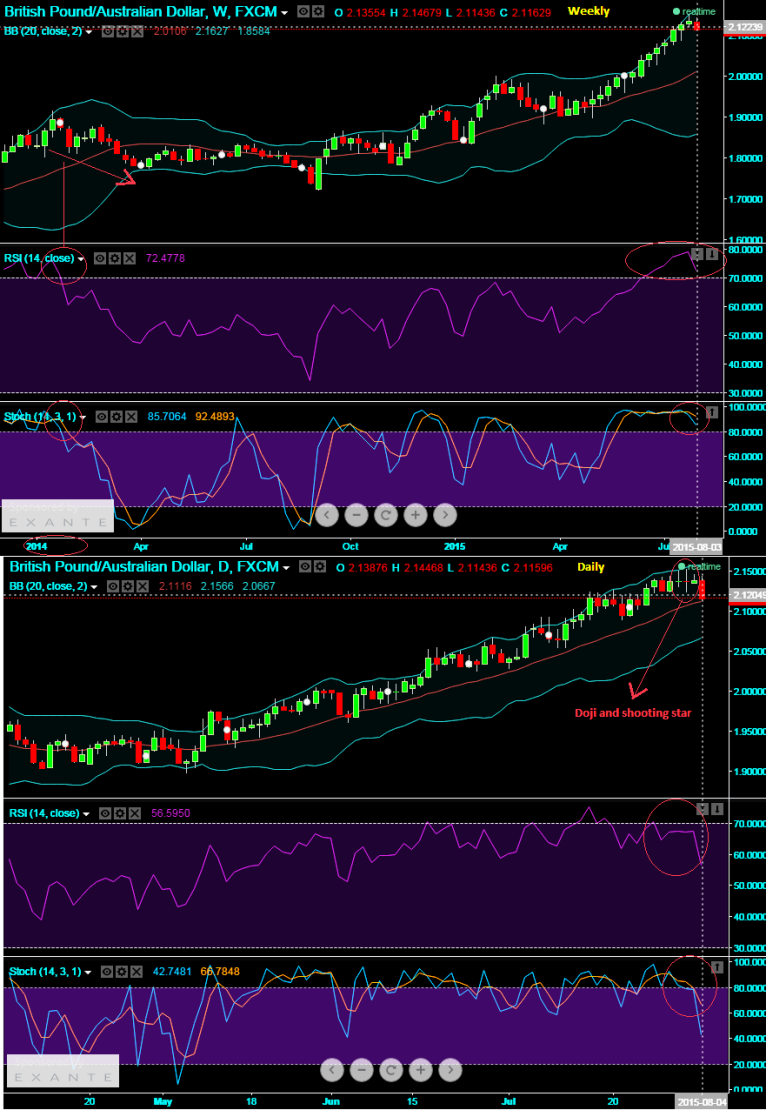

We spotted out a clear sell call on this pair 1st time ever since February 2014. Why we are calling this as clear sell is that we often urge technical should not studied in an isolation as a particular signal should be precisely justified and substantiated in enough confirmation with other indicators, trend or whatsoever.

While we were designing long term hedging framework 14 week RSI was used with an objective to track price momentum over medium to long term perspectives. As shown in the diagram, when strength index curve approached 80 levels (i.e. overbought territory) a steep divergence is evidenced around 2.1467 levels. Divergence on weekly often takes many weeks to correct these price discrepancies. For a swing trader it is all too easy to be carried away by a market that apparently knows no bounds.

Slow stochastic on the other hand also evidences overbought scene as %D line crossover above 80 levels which is again overbought zone. The same was confirmed with daily charts as both leading oscillators evidence the same situation and substantiated better with some bearish candles such as Doji and shooting star patterns at 2.1376, 2.1378 and 2.1387 respectively. Currently on weekly charts, RSI is trending at 72.2698, %D line at 92.5050 while %K line at 85.8124 levels.

On hedging grounds, 1M At the money -0.47 delta puts are recommended in debit spreads combining with in the money puts of 7D maturity. But on speculating grounds, buy digital vega puts for targets of 15-20 pips.

FxWirePro: Weekly RSI indicates short GBP/AUD first time since Feb 2014; prefer vega puts for hedging and speculating

Tuesday, August 4, 2015 7:00 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings