The key topic was still Chinese PMIs. Normally the market impact of economic data is short-lived, but obviously, the Chinese PMIs have a much longer and bigger market influence. While the PMI could be impacted by a lot of unknown factors, it still looks like there have emerged some green shoots in China’s economy.

The Caixin manufacturing PMI soared to 50.8 in March 2019 from 49.9 in the previous month, beating market expectations of 50.1. The latest reading pointed to the first increase in manufacturing activity in four months and the strongest since July 2018, as new order growth accelerated to a four-month high, boosted by a rebound in new export orders, and employment increased for the first time since October 2013, with some firms mentioning they were hiring additional workers to support greater production and new business developments.

We reckon that it is better not to take a one-sided opinion. The risk-reward is usually not good if you follow the consensus. The strong Chinese PMIs somehow suggest that the activity data for March would very likely bring in upside surprise, which is almost fully priced in by the market rallies. But what the market might have not been prepared is that the Chinese central bank could hold on the easing tap at some point as the inflation data could also surprise on the upside. Again, it is always important to have a balanced view of China.

OTC FX updates:

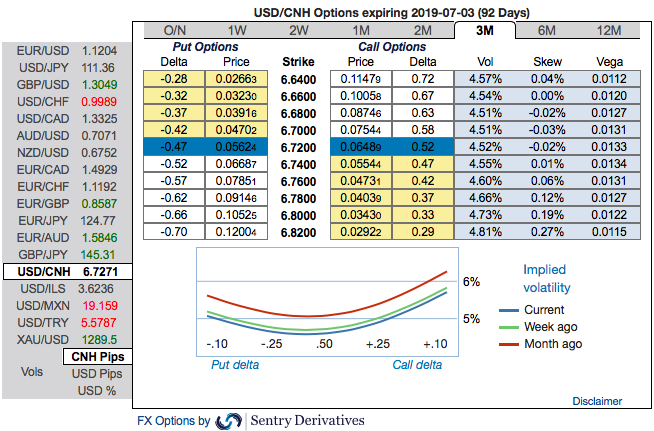

You could easily make out that the positively skewed 3m IVs of USDCNH have been stretched out on either side but little bullish bias (refer above nutshell). This is interpreted as the hedgers' bid for both deep OTM calls and OTM put options.

Trade tips: Buy 3M 40D (6.76 strikes) USD calls/CNH puts vs sell 3M 5.50. Courtesy: Sentrix, Tradingeconomics & Commerzbank

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards 81 levels (which is bullish), and hourly CNY spot index has been bearish, creeping at -42 (bearish) while articulating (at 14:01 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?