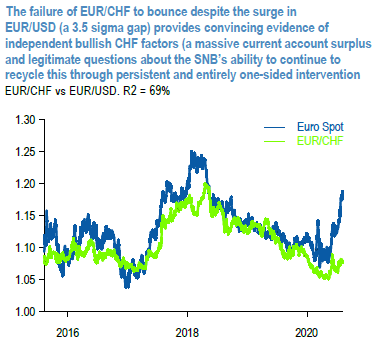

USDCHF has served us well as a proxy EURUSD long. But this is far from being the only reason to hold a CHF long. The chart demonstrates EURCHF that is now nearly seven cents too low given the surge in EURUSD, an undershoot that we take to be compelling evidence of the independently bullish factors that have boosted CHF, and will likely continue to do so.

In essence this is a current account disequilibrium on steroids, insofar as Switzerland found it almost impossible to recycle its 10% of GDP current account surplus even before the onset of global financial repression, hence the reliance on persistent SNB intervention to generate the necessary capital outflows.

There is no definitive limit on the SNB’s ability to continue with this policy to blunt fundamentally justified CHF appreciation in this way; nevertheless, we suspect that an adverse finding by the UST about currency manipulation in its next report would increase pressure on the SNB to scale back its activities and permit rather more CHF appreciation.

While such a finding is not necessarily guaranteed even if Switzerland does now satisfy the three objective criteria to identify manipulation criteria, we continue to regard the forthcoming report as an important asymmetric risk factor for CHF, one that is worth pre-positioning for. Trade tips: Stay short in USDCHF at 0.924. Marked at +1.73%. Courtesy: JPM

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan