USDJPY OTC update and options strategy as follows:

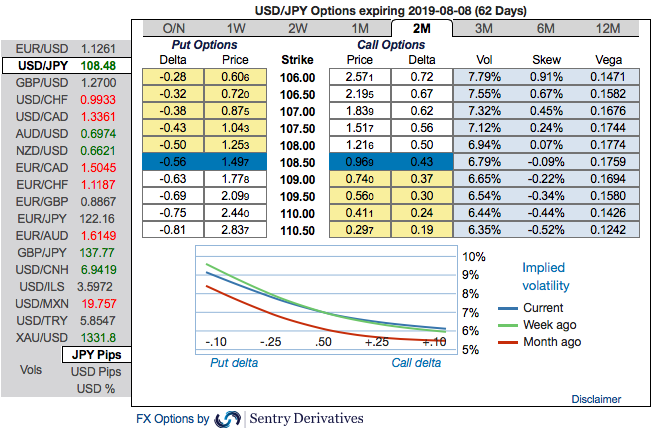

Please be noted that the positively skewed IVs of 2m tenors are signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 106.00 levels. This indicates hedgers’ interests in OTM put strikes, overall, put holders are on the upper hand.

While negative risk reversal numbers of USDJPY across all tenors are also substantiating downside risks amid any momentary upswings in the short-run.

OTC positions of noteworthy size in the forex options market can stimulate the underlying forex spot rate. The spot may trend around OTM put strikes as the holders of the options will aggressively hedge the underlying delta.

The fundamental drivers spot FX: The US trade deficit narrowed somewhat in April, to USD50.8bn from USD51.9bn. The consensus was for a USD50.7bn trade deficit. Exports and imports both fell by 2.2% MOM. Initial jobless claims remained at 218k last week, well in line with consensus (215k). The previous week was revised up from 215k to 218k. The 4-week average fell by 3k, to 215k.

But for this month, major central banks (BoJ and Fed) are center of attraction as they will announce their monetary policies by mid-June (on June 19th), BoJ is most likely to maintain negative rates on hold. The BoJ will be in focus for now and we expect them to follow in the footsteps of other DM central banks and turn more dovish, which should still be conducive of selling USDJPY downside.

Trade recommendations: USDJPY spiked from 107.815 the recent lows to the current highs of 108.596 levels, the defensive yen are still on the cards. We feel quite fortunate to be exiting in the black having owned USDJPY through a deep and sometimes volatile correction in US stocks.

Hence, at spot reference of USDJPY: 108.562 levels, we advocate buying a 2M/2w 110/107.00 put spread ahead of Fed and BoJ monetary policies (vols 6.61 vs 6,89 choice), wherein short leg is likely to function if the underlying spot FX keeps spiking, we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds. The lower/shrinking implied volatility is good for options writer and increasing realized volatility is good for the bearish trend. Hence, the above strategy seems to be the best suitable in prevailing volatile conditions.

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 76 levels (which is bullish), while hourly USD spot index was at 60 (bullish) while articulating at (09:33 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch