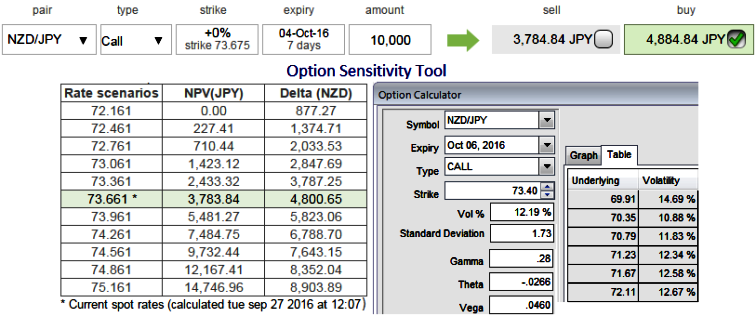

1w ATM calls of this pair are trading 29% more than NPV.

1w ATM implied volatilities are at 12.19%. Standard deviation of this call options 1.6

Hence, we see there exist disparity between IVs and option pricing.

While if you have to think economic event risks, very little AU or NZ releases over the next 28 hours.

China industrial profits finding support from commodity and steel prices, but the pace of growth still soft relative to history.

Moreover, if you have to observe the impact of all these factors in currency prices, technically, On monthly charts, the price declines consistently below EMAs and more slumps likely as spinning top and doji appear with huge volumes. For now, stiff resistance is seen at 73.597 level.

During the month ahead any probe above 73.597 is possible, driven by good quality NZ economic data, and a BOJ’s shift in monetary policy stance, and US treasury yield-chasing inflows. By year end, there’s a case for a correction towards 71.249 levels as the RBNZ eases OCR below 2.00% in November as per the expectations.

Contemplating all these factors lingering around spot NZDJPY rates, we foresee opportunity lies within shorting an OTM call options in any hedging or speculating strategy would determine to be the best selection of option instrument.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes