We’ve shown here some significant factors that determine the underlying spot FX price of USDJPY:

1) If the strong US growth leads aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength, and

2) If Japanese government’s fiscal policy becomes more expansionary and the BoJ finances it, resulting in higher Japan’s inflation expectations,

Then, we could foresee bullish USDJPY scenario hitting to 125 levels on above fundamental driving forces.

Where USDJPY is projected to slide towards 100 if:

1) The global investors’ risk aversion heightens significantly,

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness, and

3) The expectations for more hawkish than expected personnel change of the BoJ heighten.

Options trades recommendations:

Buy GBPJPY – USDJPY 1Y ATM straddle spread, equal JPY vega.

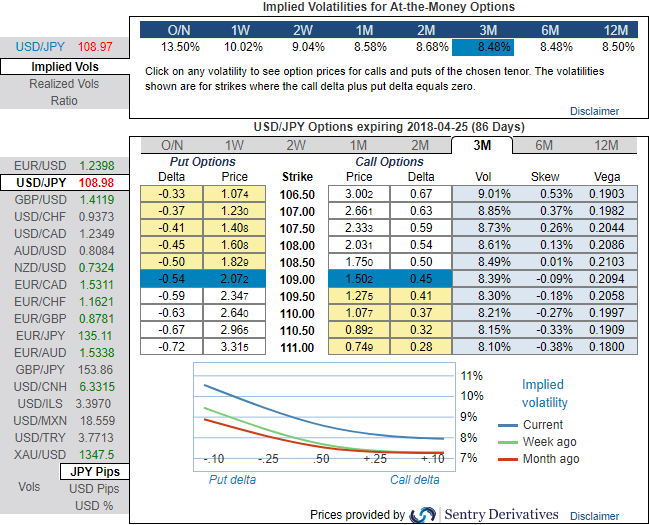

The implied volatility of ATM contracts of USDJPY is trading at around 8.48%-8.58% for 1-3m tenors, as the delta risk reversals flashing up progressively with positive sentiments in near terms that signify the shift in hedging sentiments for downside risks in near terms, this appears to be conducive for put option writers. Positively skewed IVs of 3m tenors are signaling bearish risks.

Thus, we advocate buying USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 109.029).

Currency Strength Index: FxWirePro's hourly USD spot index has shown -62 (which is bearish), while hourly JPY spot index was at 86 (bullish) while articulating at 07:43 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different