What-if below driving forces materialize? a scenario analysis:

1) Eventual repatriation by US corporates-EUR accounts for a third of foreign profits.

2) EUR appreciation delays ECB policy normalization (change in QE guidance delayed until April).

3) Euro growth relapses to 2.0-2.5%.

We could foresee Bearish EURUSD scenarios on above-stated factors.

What-if below driving forces materialize? Alternative scenario analysis:

1) The ECB changes guidance in March, heralding an end to QE in Sept and hikes by 1Q’19.

2) Euro growth sustains above 3% into 2H’18.

3) Concerns about the US twin-deficit intensify.

On above-stated factors, we could foresee the bullish EURUSD scenarios.

OTC outlook and options strategy:

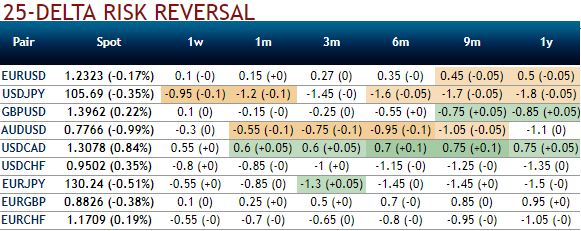

Please be noted that the above nutshell showing 1Y IV skews of this pair that has been well balanced on either side. The implied volatilities have still been lower among the G7 FX space and you could also make out that there has been the shift in long-term hedging sentiments for bearish risks (negative change in risk reversals across longer tenors are substantiated by positively skewed IVs on both OTM and OTM calls strikes).

Well, contemplating these OTC indications, using reverse collar spread options strategy, the investor gets to earn a premium on writing overpriced puts capitalizing on lower IVs, simultaneously add a protective at the money call option bidding positive RRs.

This is a suitable strategy where the aggressively bullish investor sells out of the money puts against a holding of the underlying spot outrights but keeps upside risks on the check.

Buying ITM call options gives you high positive delta, unlimited profit potential, and therefore if you are expecting the underlying FX pair to spike up ascetically with the possibility of going much higher, you would buy ITM calls.

On the flip side, shorting OTM puts fetches you certain returns but limited profit potential as long as the underlying spot FX remain above the strike price so if you are expecting the underlying pair to remain more or less sideways or upwards just a little bit, you would do this instead.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above -37 levels (which is bearish). While hourly USD spot index was inching towards 31 (bullish) while articulating (at 10:28 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close