Consolidation has proved to be the order of the last twenty-four hours, as equities across Europe, US (yesterday) and Asia rallied following reports that China is to send a delegation to discuss trade with the US. Markets will still be sensitive to geopolitical developments, but successive subdued sessions (in terms of both trade tensions easing and emerging market currency volatility falling) may see attention shift elsewhere.

One factor that may move back into the middle of the market’s line of sight is Brexit. Negotiations between the UK and EU resumed yesterday, following comments earlier in the week from Foreign Secretary Jeremy Hunt that ‘no deal’ risks were rising. There were few headlines yesterday, but according to Bloomberg, the EU’s chief negotiator Michel Barnier may hold a press conference today.

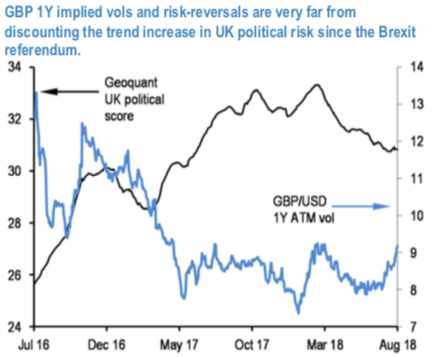

GBP vols and risk-reversals are relatively low for a ‘no deal’ Brexit outcome that has begun to be discussed in UK policy circles.

We discuss a slew of bearish GBP hedges, including deep OTM GBP put/USD call digital options, GBPCHF – USDCHF vanilla put switches and (GBPUSD, USDCHF) dual digital options.

The lingering sentiments around the likelihood of ‘no deal’ Brexit have ratcheted higher of late, most recently following International Trade Secretary Liam Fox’s pegging the odds of such a scenario at 60% in an interview.

One could argue that GBP vols and risk-reversals have not kept pace with the trend increase in political risks in the UK since the Brexit referendum. 1stchart exhibits a new-age index of political risks scored by Geoquant based on a mix of structural country risk metrics and higher frequency formal and social media data (GEOQUKPR Index(go)); its lack of directional correlation with option price based measures of sterling risk suggests that an unpleasant surprise could be in store for GBP options should markets focus more squarely on the no deal scenario.

Considering 1.20 on GBPUSD to be the hard Brexit threshold – not unreasonable since 1.20 is the spot low in the aftermath of the Leave vote in 2016 – pricing on 1Y 1.20 strike GBP put/USD call digital options of 15.7% of USD notional (mid) at current market (spot reference: 1.2713 levels) strikes us as being on the low side, on net indicating that option markets assign more than 50% additional probability to a benign resolution to UK/EU.

A straightforward application of the digital option pricing exercise above is to own deep OTM GBP put/USD call digital options. 1Y 10% TV GBPUSD put digitals pricing ticked higher but still trades only a tad from multi-year lows in premium, as evidenced by the spot-to- strike distances of such options in (refer 2ndchart). Cost-of-carry/rate of premium decay are unavoidable real-world considerations, and on this front, digitals/put spreads offer greater staying power in the process that is likely to be the erosion of the pound’s value in coming months. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is displaying shy above -51 levels (bearish), while hourly USD spot index was at -27 (bearish) while articulating (at 09:08 GMT). For more details on the index, please refer below weblink:

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge