The euro area corporates are in a good position to expand, the corporates in this geography have become net savers and low-interest costs, lower dividend payouts, lower CapEx explains the shift.

Corporates’ capacity to accelerate CapEx looks good.

A couple of months ago, we still expected the Euro area to grow at only a modestly above-trend pace this year. However, business and consumer sentiment have improved sharply, with the composite PMI signaling 3% growth in March. This prompted us to raise our 2017 growth forecast to 2.2% Q4.

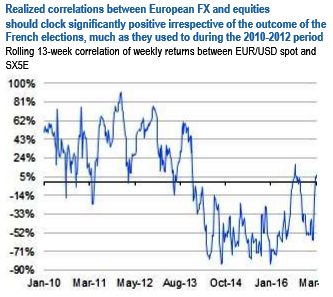

European FX vs. equity implied correlations currently trade in the 0 -20% range in 6M –1Y expiries, which might be fair relative to current realized correlations but ought to reprice higher in coming months if a concerted European asset rally reverts corrs back to average levels of the 2010-2012 period (refer above chart).

Investors have already started to take advantage of this dislocation and forced short-dated (<3M) EURUSD vs. SX5E correlations up to +25%, but there is still room for the move to play out in longer tenors.

EURUSD > 2% OTMS, SX5E > 5% OTMS: dual digitals costs 14.5% EUR indic. in 3M tenors (indiv. digis 43% and 26% respectively) and 18.5% EUR indic. in 1Y (indiv. digis 58% and 37% respectively).

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed