Usually, there would always be a build-up before major events. Likewise, ECB seems to be limiting the tractability: ECB President Draghi hinted at the last press conference, that the central bank had by in no manner casted-off all its missiles yet.

In its monthly report, it sees upside risks for the economy thanks to strong exports and good prospects for industrial production, which strengthens the reasons for reducing the monthly ECB purchases. Even if ECB President Mario Draghi does not want to announce these in Jackson Hole – he will not be able to distance himself notably from them either. After all the legal limits self-imposed by the ECB are getting increasingly close.

That means Draghi’s appearance will be a balancing act - not just as far as ECB policy is concerned but also as regards the euro. The euro too was mentioned in the Bundesbank’s monthly report. Price pressure from abroad is likely to ease as import prices have already fallen recently due to the strong appreciation of the euro. Even if Draghi does not even want to suggest a verbal intervention against EUR strength he cannot come across as completely carefree regarding the euro either.

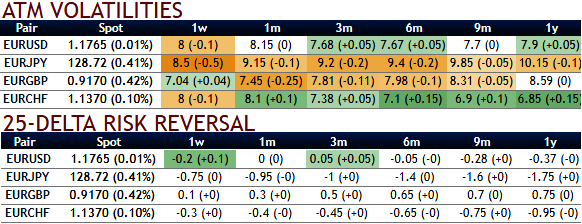

Consequently, the influential beta-forces of euro-strength/dollar weakness continue to preserve prevailing vol themes of gamma strength, vol curve flattening and risk-reversal underperformance.

Event premium over a busy late August-September period spanning Jackson Hole and ECB/Fed meetings is relatively underpriced in GBP and SGD. USDCHF 3M3M FVAs have lagged the recent upturn in CHF complex vols and are value buys along a mildly inverted curve.

Please be noted that the implied vols of euro crosses have been tepid despite the series data flows are lined up.

Today’s data announcements:

France Markit Mfg, Service and composite Flash PMIs, Denmark Consumer Confidence, Germany Markit Mfg, service and composite PMIs, Eurozone Markit Mfg, service and composite Flash PMIs.

EUR vol risk reversals remain low compared to the level of rates. Also, in longer tails, the EUR volatility smile remains flat compared with the rates vs vol correlation seen since 2015 and over the past week.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate