AUD finished 2017 as the fifth best performing G10 currency against the USD, surpassed only by European currencies (EUR, DKK and SEK) and Sterling. This was a reasonably good performance for a currency whose economy remains desynchronized from the global upswing and whose central bank is firmly on hold with the policy rate sitting at a historical low. In 2018, we expect AUD’s ranking within the G10 to slip a few places; we are forecasting a steady decline towards USD0.72 by year end.

AUDUSD below 0.75 if:

1) The unemployment rate moves back towards 5.75%, raising risks that the RBA responds to a weakening labor market;

2) The Fed responds to firm labor market outcomes and above-trend growth by delivering a faster pace of hikes than currently expected;

3) China data weaken materially; or

4) The risk markets retrace and vol rises as financial conditions tighten.

While AUD has been a strong USD-hedge candidate since one-touch AUD put pricing benefits from wafer thin forward points and risk-reversals that renders negative carry of AUD selling almost negligible, and the underlying itself provides fundamental diversification for the broad reflation theme given Australia’s unique domestic headwinds, as well as useful equity beta should the breakneck rally in stocks hit a roadblock.

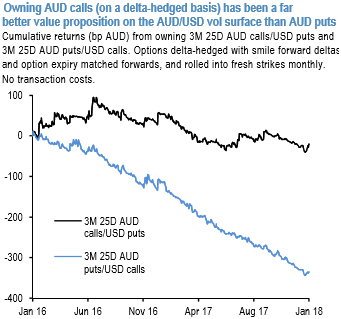

That AUD is worth selling via options does not necessarily imply we find AUD risk-reversals “cheap” enough to warrant owning vanilla AUD puts outright, (please be noted that mounting bearish sentiments in 3m tenors and these sentiments remain intact in 9m & 1y tenors, refer above nutshell) – indeed, recent spot-vol correlation in AUDUSD has been sharply positive (spot up, vol up) in defiance of the persistent bid for AUD puts on riskies, indicating much better value in owning AUD calls rather than puts on the surface (refer above chart).

In light of this, the reduced risk-reversal sensitivity of one-touches is preferable to vanillas while still retaining healthy mark-to-market P/L sensitivity to spot moves. Off spot ref. 0.8070, consider 2M 0.77 strike AUD put/USD call one-touches for 20.7% indicatively.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards 15 levels (which is neutral), while hourly USD spot index was at a tad below 100 (highly bullish) at the time of articulating (at 07:42 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data