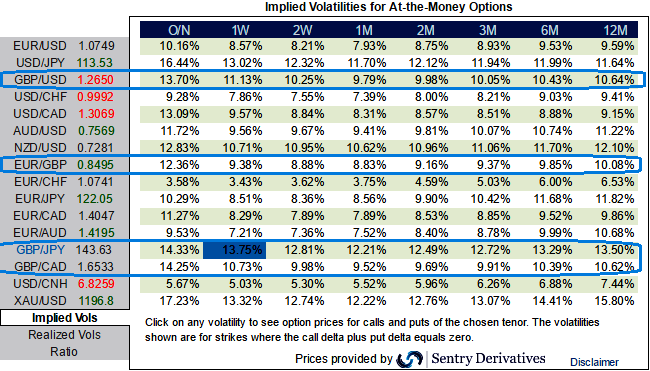

The ATM volatility of GBP crosses are reasonable rising higher levels until next week’s BoE monetary policy meeting, although we are expecting a calm down a little after another roller-coaster ride in the GBP around the BoE meeting on next Thursday.

Despite GBP/JPY downtrend seems to be intact, a lot of bad news is already priced in and digested by the market, preventing it from being overly bearish. Brexit caused two Sterling debacles, first in June with the vote and then after the summer when PM May suggested a hard exit. Cable lost almost about 15% over a quarter and it now seems the dust has settled. In the process, volatility fell but remained relatively high on a historical basis. Assuming a medium-term range in cable and that negative surprises are no longer market tail risks, the GBPUSD volatility is a Sell.

Hence, even if the aggressive volatility investors wants to capture GBP should consider buying ATM instruments and/or being long of the smile convexity, against ATM volatility. But further GBPJPY weakness and/or abrupt upswings suggests building a directional and volatility patterns at the same time: the value of OTM puts would unlikely to rise significantly as the IVs do not seem to be favoring these distant strikes. We, therefore, recommend buying a 3m IV skews and risk reversal with ATM options.

Option Trade Recommendation:

Go long in 2 lots of 3m ATM -0.49 delta puts, while long in 1 lot of +0.51 delta call of the similar tenor, See that payoff function the strategy likely to derive positive cashflows regardless of swings but more potential from 2 puts are more than 1 call.

The risk is limited to the extent of the price paid to buy the options.

The reward is unlimited till the expiry of the option.

Please note that as shown in the diagram the trader can still make money even if he was wrong – but the spot FX has to move in the opposite direction really fast. The 1 call bought has to beat the cost of buying all the options and still bring in some profits.

When to use this strategy: Suppose any negative surprising news from next week’s BOE meeting that could revolve GBPJPY and you want to take your odds on downside risks – you can trade a strip.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data