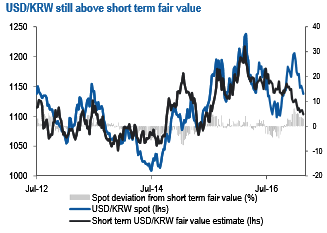

KRW still cheap relative to global reflation theme. At face value, we don’t believe all of the good news is priced in. The short term fair value model has taken another leg lower and now sits around the 1100 level (refer above chart).

For much of January/February, the fair value estimate was around 1110/1115 but renewed strength in local equities has pushed the fair value estimate lower (from a USDKRW perspective) over the past week.

Higher commodities since the start of the year have also been a factor, while yield spreads have broadly moved sideways over this period. We have seen spot USDKRW trend towards the fair estimate but there is still a reasonable wedge between the two series (albeit not as large as it was at the start of the year).

We still like to maintain longs in USDKRW 2m NDFs, so, initiate longs in USDKRW 2m NDF at 1156 with a target at 1245 (+5.3%) and a stop at 1133. The time horizon is 1-2 months and positive carry is approximately 2bp/month.

We retain our thesis that USD-EM has further upside in Q1. The KRW remains in the cross hairs of higher US yields, protectionism and geopolitics, a China growth slowdown and RMB depreciation.

Ongoing deterioration in rate differentials should keep the KRW trading on the back foot and negative forward points affords the opportunity to establish long dollar exposure with a positive (albeit small) carry profile.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different