Although we are scaling an NZD short, appending a spot position to augment a digital put of other pairs that are only very low delta now, other NZD crosses have been flattered by the abrupt re-pricing of RBNZ policy a month ago but positions should be cleaner now and NZD hence more vulnerable to a further attrition in global macro confidence.

EURNZD retains upside potential beyond 1.6714 levels, in the wake of the dovish ECB shift and mixed EZ economic data. The next big event is the ECB on 10 April.

In the medium term perspective, the ECB has delayed plans to hike rates and instead initiated further stimulus in the form of cheap bank loans. We target 1.6714 by the end of Q3’2019.

On the flips side, RBNZ is all set for its monetary policy this week for OCR review that may disappoint NZD-bears. On a broader perspective, OCR reviews that are scheduled on this Wednesday, which may disappoint NZD bears with unchanged guidance (developments since the Feb MPS have been roughly neutral). On Thursday, we get to hear from RBNZ Gov. Orr about the new monetary policy regime.

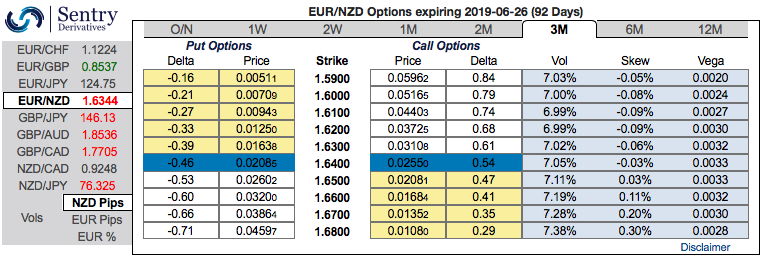

OTC outlook and Hedging Strategy: Please be noted that the positively skewed IVs (implied volatilities) of 3m tenors signify the hedgers’ interests in the upside risks (refer above nutshell). Bids for OTM calls strikes up to 1.68 levels are observed ahead of RBNZ monetary policy.

Contemplating all the above factors, we could foresee the upside risks of this pair. Hence, we advocate 3m (1%) in the money delta call options.

Thereby, in the money call option with a very strong delta will move in tandem with the underlying spot fx.

Alternatively, as we could foresee upside risks in the weeks to come, ahead of RBNZ’s monetary policy this week on hedging grounds, we advocate initiating longs in EURNZD futures contracts of mid-month tenors with a view to arresting further upside risks. Courtesy: Sentrix & Westpac

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -168 levels (which is bearish), while hourly CHF spot index was at -77 (bearish) while articulating (at 13:10 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise