The UK election that took place recently decreed a landslide victory for the Conservative party, granting the current PM Johnson a majority government (not relying on DUP support) and some margin for managing both future negotiations with the EU and hard stances on Brexit from the right-wing ERG within Tories.

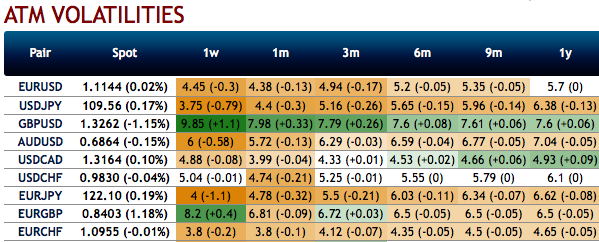

GBP flashes with highest IVs (implied volatility) among G7 FX-bloc, headroom is capped as investors have no clarity about the most important issue that will determine the economic consequences of Brexit - the future trade deal - albeit Johnson’s WA envisages a looser set of arrangements than May’s ill-fated deal. Moreover, there is still the risk of an economic cliff- edge at the end of 2020 if Johnson honours his commitment not to extend the one-year transition.

GBP's REER is cheap, 11% vs a 20Y average, but delivery of Brexit won't eliminate the bulk of the undervaluation. Much of this is as a consequence of the UK's worst-in-class current account deficit.

PM Johnson might now put the withdrawal agreement to a vote in the House of Commons as early as next week. The immediate effect post-election has been that of a repricing of sterling (up around 2% vs. USD and EUR) and of a crashing of front-end vols (1M cable vol down by more than 4 vol points), with the risk of an end-of-January no-deal now almost completely removed.

Regarding the 1y1y forward vol idea we had proposed in the Outlook, its MtM performance (-0.6 vol points) has been directly impacted by the sharp drop of vol levels. Amongst the scenarios that were highlighted in the FX Outlook regarding the election, the one most supportive for the long fwd vol idea was that of a tight Conservative majority, reducing the likelihood of an extension of the transition period and increasing that of a no-deal on trade by Dec'2020. While the delivery of Brexit on 31 January can now be taken as assured, it remains to be seen what strategy the UK government will pursue on the future relationships with the EU. It was been argued that such a solid majority could allow the PM Johnson to implement a more moderate approach, with an increased focus on economic needs than on ideology. One piece of feedback we received on the idea regarded the choice of the expiry for the construct, suggesting that shorter expiries like 3M would have offered more upside potential (for the same vol level given the flatness of the curve) in case of a hard-cliff on trade to take place at the end of next year.

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts