JPY has been the weakest within the G-10 camp, weakening 3.4% against the dollar and 2.8% in trade-weighted terms. Despite a larger-than-anticipated rally in USDJPY since the US polls, it is still believed that the rally is not sustainable and the pair would resume its downtrend sooner than later in short run.

As per the US-JP 10-year yield spread as explanatory valuables, the USDJPY fair value is around 107-108 in near terms.

Consequently, the current level of the pair seems to be overestimated and the USDJPY decline in the mid to long-term we expect is seen as a mean-reversion move.

Bullish USDJPY up to 125: Given 1) Strong US growth leads aggressive Fed hikes and a spike in UST yields, resulting in broad USD strength, 2) the BoJ accelerates debt monetization and Japan’s inflation expectations materially rise.

Bearish USDJPY scenario up to 105: Given 1) Global investors’ risk aversion heightens significantly due to concern on the US and European politics, 2) Weak US economy dampens hopes for Fed hikes and leads broad USD weakness, 3) Trump administration starts talking down USD aggressively.

Most importantly, the BoJ would meet on January 30-31st. While the inaction of the BoJ is expected until Kuroda’s term ends in April 2018, Outlook Report will garner attention at the upcoming meeting. Given firm tone in oil prices and USDJPY into this year, whether the BoJ shares a positive view towards inflation outlook would be of interest.

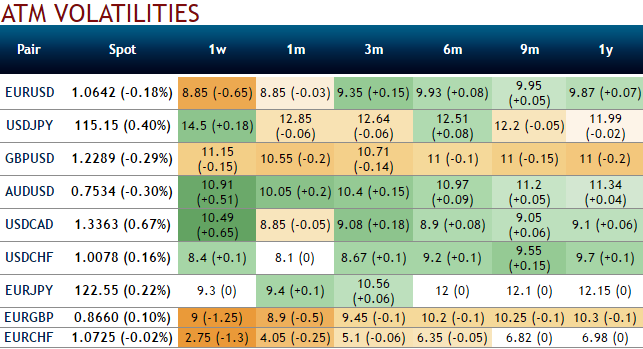

As a result of BoJ event, you could see positive hedging bids for USDJPY in 1w risk reversals and IVs are evidencing mounting hedging interests for upside risks (while articulating). Hence, even the underlying pair keeps dragging it drags maximum up to above-stated levels within a span of 3m tenors.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential