As today's trend being uptrend bias we foresee buying chances on every dips by preferring binary calls for targets at 135.0733.

But on long term hedging perspectives bear put spreads are advised.

Bear Put Spread shall be used over Protective Put when the premiums on Protective Puts are too costlier.

Bear Put Spread = Protective Put + Sell another Put with lower Strike Price (Out of the Money).

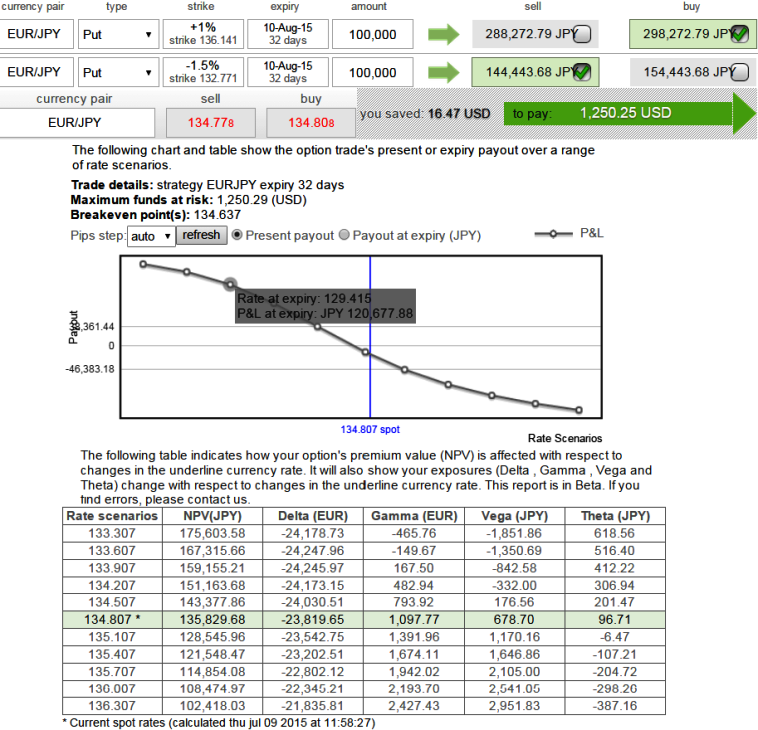

Hence, buy 1M (1%) In-The-Money -0.59 delta put and simultaneously sell 1M (-1.5%) Out-Of-The-Money put with positive theta of the same maturity.

The combined position should have -0.23 delta and theta close to 95.

As we make out a further appreciation in JPY currency against euro on technical terms, simple bear put spread can offer a partial hedging on this pair.

This partial hedge strategy minimizes the potential losses if the underlying currency has to move lower but does not cap the loss.

But the advantage is that this strategy reduces the cost of hedge by the premium collected on the Out of the money Put but it comes at the expense of Partial hedge rather than a complete hedge.

FxWirePro: speculate EUR/JPY with binary calls, hedge with put spreads

Thursday, July 9, 2015 6:44 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings