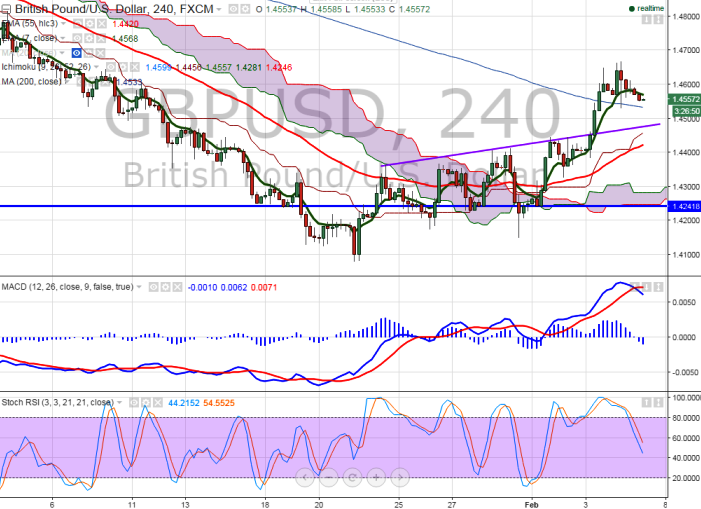

- Major resistance -1.4675 (55 day MA)

- The pair has declined after making a high of 1.46677 post Hawkish BOE monetary policy. It is currently trading around 1.45564.

- Bank of England cuts inflation and growth projection yesterday, and this confirms that central bank unlikely to hike rates soon.

- On the lower side minor support is around 1.4520 and any break below targets 1.4480/1.4440/1.43750.

- Any break above major resistance 1.4675 will take the pair to next level around 1.4750/1.4795.

- The minor resistance are around 1.4600/1.4650.

It is good to sell on rallies around 1.4575-580 with SL around 1.4680 for the TP of 1.4325/1.4240.