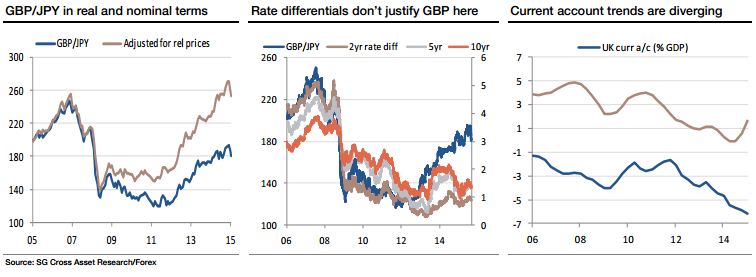

Since Abenomics started weakening the yen in late 2012, GBP/JPY has gained nearly 50%. The gain in real terms is over 60%. The result is that by pretty much any measure, GBP is now overvalued relative to the yen. Shifts in relative interest raters justify only a small (and decreasing) part of the move. The yen's undervaluation limits potential upside to GBP/JPY in the event of the UK MPC tightening faster/more than expected, but by contrast, there is considerable downside to GBP/JPY if the UK economy slows, if Brexit fears return in earnest, or if a resumption of wide-scale risk aversion causes safe-haven flows into the yen.

In the current uncertain climate, with concerns about the Chinese economy and policy, with falling commodity prices and with the threat of renewed risk aversion as the date of the first US Federal Reserve rate hike gets closer, the 'ideal' currency to buy would be 1) cheap, 2) a major oil importer which benefits from falling prices, 3) from a country with a current account surplus and strong net international asset position to cushion it from financial market turmoil. The yen meets these conditions. The 'ideal' currency to short would be overvalued, with a big current account deficit, a negative net international investment position and an energy exporter. Sterling doesn't qualify on the last, but otherwise, at least against the yen, it scores pretty highly. That makes for a 'central case' outlook of modest weakness and a lot of negative skew to the range of potential outcomes.

The main risks are continued GBP strength if rates rise faster than expected, and yen weakness from another round of QQE (expected by most, and largely priced in).