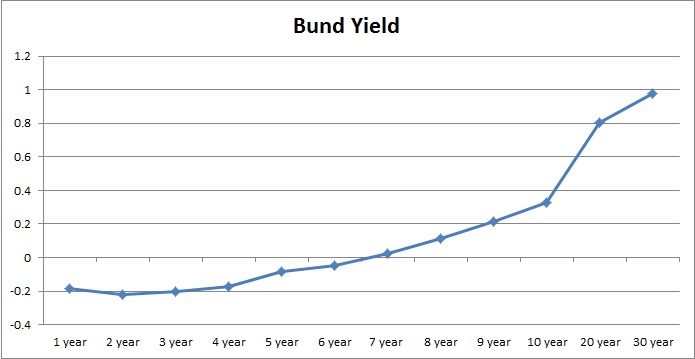

- ECB bond purchase of € 60 billion per month is about to start today and in anticipation of such German bund yield have further moved to negative territory.

- All economic dockets point that Germany is the Europe's strongest economy, today manufacturing PMI improved to further 51.1 above average of Euro zone's at 51. In such context the German capital market is expected to perform better than the peers and bond yields to sink further.

- ECB has iterated that it has reached the lowest boundary for rate cut, at least for time being. Current deposit rate is - 0.20 percent.

- The shorter end of the curve may remain anchored close to the level just below zero and the longer end may continue to flatten further as ECB starts its purchase programme.

This year's top trades could come out as overweighting the equity market spread in favor of Germany and shorting the long end of the curve. Only caution for the latter one is inflation which still runs negative across board.

|

Maturity |

Current |

|

1 year |

-0.184 |

|

2 year |

-0.22 |

|

3 year |

-0.2 |

|

4 year |

-0.174 |

|

5 year |

-0.081 |

|

6 year |

-0.049 |

|

7 year |

0.021 |

|

8 year |

0.112 |

|

9 year |

0.214 |

|

10 year |

0.328 |

|

20 year |

0.807 |

|

30 year |

0.975 |

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?