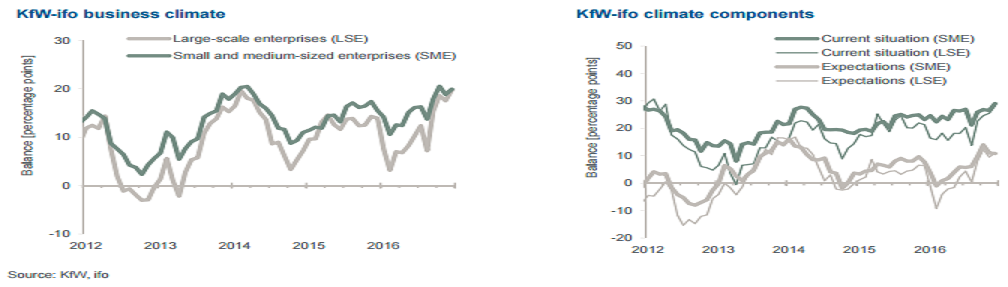

Business confidence in Germany remained upbeat during the month of December, with small and medium scale enterprises remaining in a good mood and more positive about their situation in December. Large enterprises are becoming increasingly optimistic and business confidence in the construction sector is breaking all records.

The SME business climate followed the positive trend of the year, rising to 20.0 balance points, up 1.2 points on the previous month. The indicator has thus gained nearly ten points since the low of February. The main factors that drove the improvement in sentiment were SMEs’ assessments of their business situation. They rose 2.5 points to 29.0 balance points. That was the best situation assessment in five years.

SMEs’ expectations of future business, on the other hand, just barely held steady on the previous month’s level, dropping 0.2 points to 10.8 balance points. Further, the expectation indicator, which continues to be well above average, is evidence of SMEs’ positive outlook in 2017.

The only drop of bitterness was the relatively noticeable cooling of retail sentiment in December, but only among large retailers. Among small and medium-sized retailers, on the other hand, sentiment continued to brighten, closing the year 2016 on an annual high.

German businesses are broadly optimistic about the year ahead. Elections are scheduled in the Netherlands, France and Germany, and possibly in Italy, too. Finally, tough Brexit negotiations will probably begin from spring onwards.

"Against the backdrop of significantly fewer work days, we expect overall economic growth of 1.3 percent in 2017. Germany’s upswing will enter its fourth year in a difficult environment," said KfW Research in its latest publication.

Meanwhile, EUR/USD traded at 1.04, up 0.31 percent, while at 9:00GMT, the FxWirePro's Hourly Euro Strength Index remained neutral at -35.00 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices