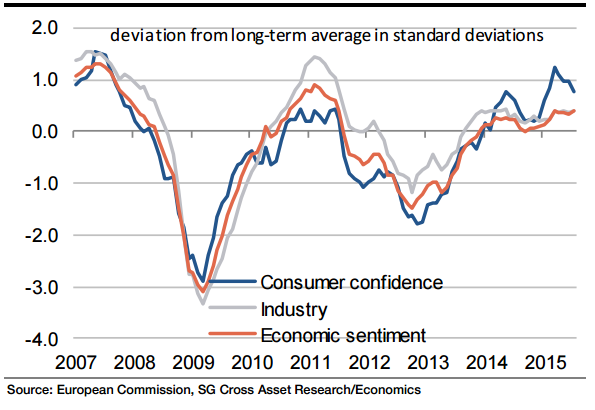

Germany looks likely to print growth of 0.3% qoq in Q2, lower than in the June forecasts. While monthly indicators suggest even lower growth, some recent data (retail sales and industrial production in June) is expected to be revised upwards. Whereas the weaker-than expected growth in Q1 (also 0.3%) was largely due to strong domestic demand driving up imports, Q2 looks set to disappoint both on private consumption and investment, especially construction. This should lead to a significant rise in savings, reflecting a temporary slowdown in consumption, influenced by rising uncertainty over Greece and China.

Construction is also likely to recover as the outlook for housing remains favourable with record-low interest rates and rising house prices, whereas machinery investment could be more reliant on the strength of consumption and external demand. Instead, net exports are likely to have been the key driver of growth, with exports having gradually strengthened as US demand improved sharply in Q2, while exports to the rest of the euro area remained anaemic and exports to China weakened. Recent forward-looking data have been mixed, with factory orders rising strongly in June but with the expectation components in surveys (ZEW, Ifo) declining in Q2 and into Q3. This may be linked to Germany's relatively higher trade exposure to Asia, and to China in particular. Consumer confidence remains high and the strong labour market should guarantee above-trend household consumption in the coming years.

"This year, we expect real GDP to grow by 1.5% and next year by 1.7%," notes Societe Generale.

German growth weaker than expected in H1 but consumption likely to return

Wednesday, August 12, 2015 10:43 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX