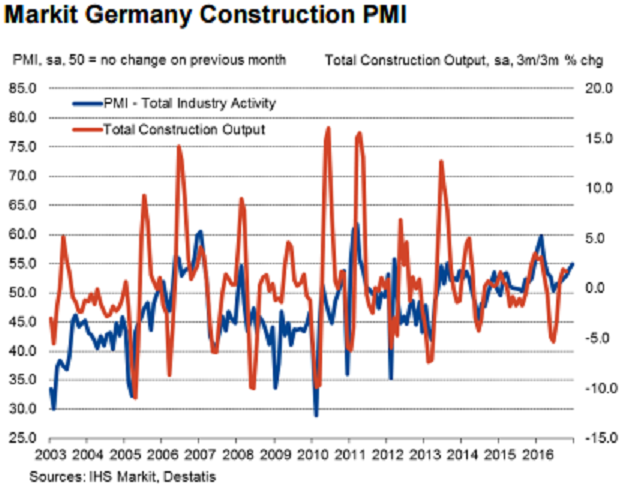

Growth of Germany’s construction sector gathered speed in December, with activity rising to the greatest extent in nine months. Higher new work was a key factor behind the expansion – the latest increase was the second-quickest on record.

At 54.9, up from 53.9 in November, the headline seasonally adjusted Purchasing Managers’ Index (PMI), which is based on a single question asking respondents to report on the actual change in their total construction activity compared to one month ago, pointed to a sharp and accelerated rise in output during December. The latest expansion was the quickest in nine months, with the fourth quarter average (53.9) being the highest since the first three months of 2016.

Activity growth was broad-based by category. Housing activity rose quickest, followed by commercial building output. Civil engineering posted only modest growth, but the rise ended a two-month sequence of decline.

Greater purchasing activity was another by-product of new business growth. Input buying rose for the seventeenth month in a row, with the latest increase the steepest since February. Improved demand for inputs was reportedly a factor behind slower deliveries, however. Suppliers’ lead times lengthened to the greatest extent since September.

Finally, optimism was widespread in December. Nearly 20 percent of panellists expect output to rise in 2017, in line with forecasts of stronger demand, new projects and better pre-planning, while only 6 percent anticipate a fall.

"With client demand strengthening, firms are optimistic about 2017-sentiment towards the year ahead improved to the best since May. However, price pressures appear a possible threat to the outlook," said Philip Leake, Economist, IHS, Markit.

Meanwhile, EUR/USD traded at 1.05, up 0.25 percent, while at 8:00GMT, the FxWirePro's Hourly Euro Strength Index remained neutral at 42.13 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target