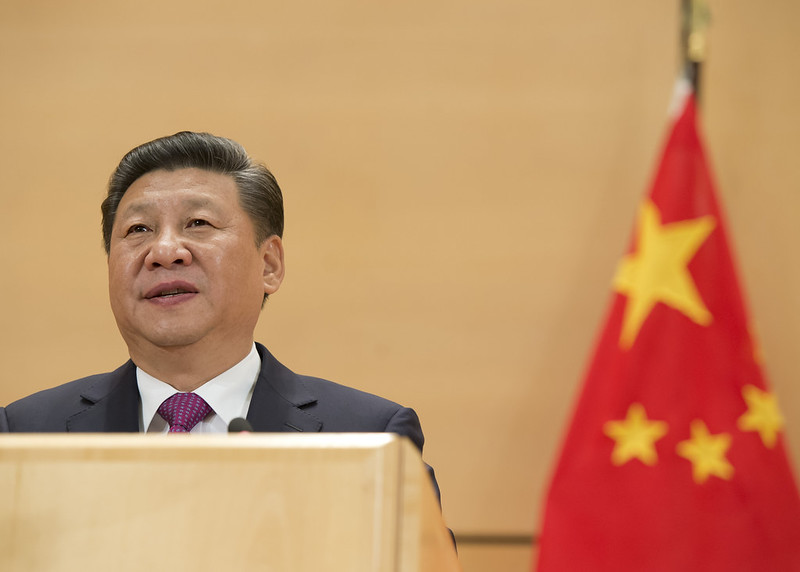

Dozens of global CEOs will attend the China Development Forum in Beijing on March 23-24, with some expected to meet President Xi Jinping on March 28. This high-profile event comes as China seeks to attract foreign investment amid U.S. tariff pressures and slowing economic growth.

Executives from major corporations, including FedEx, Siemens, BMW, Mercedes-Benz, Qualcomm, AstraZeneca, Nestlé, Saudi Aramco, Citadel, Rio Tinto, Estee Lauder, Standard Chartered, KPMG, and Deutsche Bank, are expected to attend, according to a draft agenda seen by Reuters.

While a higher proportion of European CEOs are participating, fewer U.S. executives will attend this year due to heightened geopolitical tensions. Leading American chip firms Broadcom and Synopsys are sending their CEOs, while Micron’s CFO is also invited. However, Google, Illumina, PVH, and Walmart—currently under Chinese regulatory scrutiny—are absent from the agenda.

China’s foreign direct investment declined 13.4% year-on-year in January. Meanwhile, Beijing is prioritizing domestic consumption growth to offset economic pressures, with forum discussions expected to focus on China’s medical sector and boosting consumer demand.

Xi’s anticipated meeting with a select group of foreign CEOs follows his engagement with American business leaders last year, where he reassured them of China’s long-term growth prospects. However, skepticism remains among foreign investors, with European executives citing “promise fatigue” over China’s pro-business commitments.

With China maintaining a 5% economic growth target for 2025, the forum serves as a key platform for Beijing to rebuild investor confidence and navigate the complex global economic landscape.

Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised