The Reserve Bank of Australia’s (RBA) monetary policy has a duty to maintain price stability, full employment, economic prosperity and the welfare of the Australian people and to achieve these targets RBA maintain an inflation target of 2-3 percent.

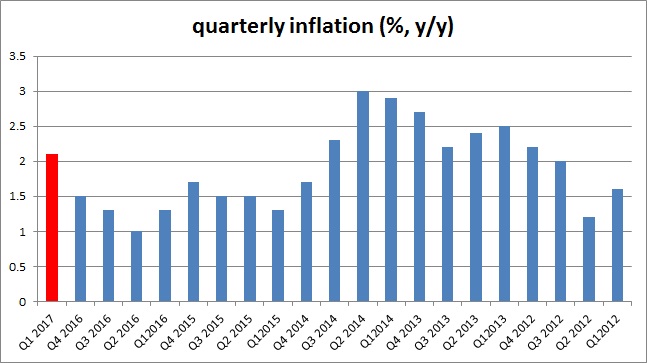

Data released earlier shows that for the first time since 2014, the inflation has reached the RBA’s target range. In the first quarter of 2017, CPI inflation in Australia increased by 2.1 percent from a year ago. Inflation grew by 0.5 percent on a quarterly basis. RBA’s own measure of trimmed mean CPI, which is more of core inflation, grew by 1.9 percent in the first quarter from a year ago. The increase in commodity prices through 2016 and in initial months of 2017 is a contributor to the increase.

However, we don’t expect the RBA to change its policy stance in the first half of the year. The recent slide in commodity prices has already pushed back rising inflation in other key economies like in Germany. Australia may suffer the same fate. In addition to that, the policymakers at the RBA would prefer for the inflation to settle in the middle of the range at least for two to three quarters before they start to change their current wait and watch policy. Currently, RBA is maintaining interest rates at 1.5 percent.

The Australian dollar is currently trading at 0.752, down -0.16 percent so far today.

Central and Southeast Europe Economic Outlook: Hungary, Croatia and Serbia Data in Focus

Central and Southeast Europe Economic Outlook: Hungary, Croatia and Serbia Data in Focus  U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns  Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion

Federal Judge Orders Refund of Trump’s Emergency Tariffs, Potentially Returning Up to $182 Billion  Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target

Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears  RBA Signals Possible March Rate Hike as Energy Risks Threaten Inflation Outlook

RBA Signals Possible March Rate Hike as Energy Risks Threaten Inflation Outlook  Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements

Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements  Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets

Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets  China Holds Loan Prime Rates Steady as PBOC Maintains Cautious Monetary Policy

China Holds Loan Prime Rates Steady as PBOC Maintains Cautious Monetary Policy  ECB Expands Euro Liquidity Backstop to Strengthen Global Role of the Euro

ECB Expands Euro Liquidity Backstop to Strengthen Global Role of the Euro  Dollar Gains as Middle East Conflict Boosts Safe-Haven Demand, Oil Prices and Inflation Concerns Rise

Dollar Gains as Middle East Conflict Boosts Safe-Haven Demand, Oil Prices and Inflation Concerns Rise