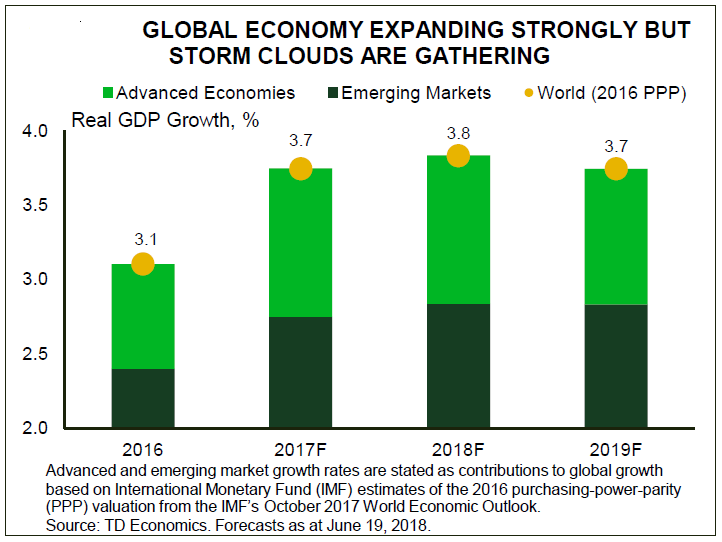

Global growth is expected to run at a robust 3.8 percent this year, similar to last year. However, this steady performance hides a weaker-than-expected start in the Euro Area and the UK, which can be partly chalked up to temporary factors, according to a recent research report from TD Economics.

Fortunately, a recovery from the first quarter stumble appears underway, with both regions expected to benefit from moderately above-trend growth over the next couple of years. It’s already becoming clear that the real standout performer for 2018 is going to be the U.S., which is tracking a 3.0 percent pace. The U.S. is widening its lead on other G7 economies this year, leading to less synchronous growth among the major economies relative to 2017.

Price pressures have also been building unevenly, with core inflation measures already near the central bank targets for the U.S. and Canada. In contrast, underlying wage and price pressures in Europe, the UK, and Japan remain relatively subdued, providing little incentive for a knee-jerk removal of past emergency stimulus.

Further the U.S. dollar rally in the past few months is a reflection of this divergence theme. This may become more difficult to sustain among the G7 currencies, as second quarter economic data offers investors more confidence. However, emerging markets remain vulnerable, as U.S. assets will remain more attractive from a risk-reward standpoint, the report added.

Within Europe, much of the slowdown earlier this year can be chalked up to weakness in France and the UK. Over the next two years, an average projection of about 2 percent for real GDP happens to land right in between last year’s solid 2.6 percent advance and the Euro Area’s long-run trend rate of about 1.3 percent.

"This means economic slack will continue to diminish, even if it’s at a slower pace than previously expected. This is why the central bank has gained confidence in telegraphing plans to commence a long-awaited tapering of its asset purchase program this year," the report commented.

At this point, G7 central banks are choosing to look-through the near-term challenges to the outlook for growth and inflation. As a result, we anticipate that the Federal Reserve is on track to push its policy rate higher in September, and Canada is likely to proceed with raising rates in July, a final time for 2018. Overseas, the Bank of England has become more patient, as unexpected economic weakness and gradually falling inflation has stayed its hand at least until this August.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient