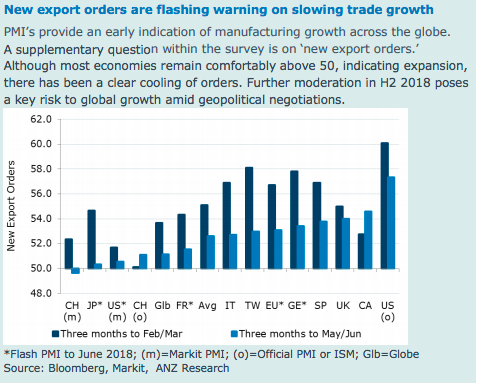

As the second half of 2018 gets under way, US trade policy is growing in importance for businesses and financial markets. Trade frictions appear to be escalating and geostrategic tensions have intensified with Washington threatening to curb Chinese investment in US technology firms, albeit through the less confrontational route of the Committee of Foreign Investment in the US (CFIUS), according to the latest report from ANZ Research.

Given China’s Belt and Road and Made in China 2025 initiatives, a protracted Sino-US trade dispute cannot be ruled out. Gradually, evidence is building that US trade policy is weighing on economic sentiment and activity. Initially, this was most apparent outside of the US. However, anxiety amongst American businesses is growing.

Fifty-one US trade groups and the US Chamber of Commerce have petitioned Capitol Hill asking that Congress pass any future tariffs Trump imposes under National Security concerns.

The announcement by Harley-Davidson that it will move part of its production to Europe in response to retaliatory EU tariffs was telling. Agreeing a framework to discuss US trade concerns is a necessary condition in stabilising business and investor confidence and ensuring the current trade “spat” does not translate into a more meaningful dispute.

Extended trade tensions have negative implications for investment and employment whilst financial markets have experienced heightened volatility in recent days as result.

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains