Gold prices declined sharply after mixed US CPI data.Gold recently dropped to a multi-month low of $2,550 but is now around $2,555.

After the release of U.S. Consumer Price Index (CPI) data on November 13, 2024, gold prices dropped significantly. Currently, gold is trading at about $2,581 per ounce, which is a decline of over 0.6%, marking a four-day losing streak after reaching a high of $2,618. The drop is largely due to a stronger U.S. dollar, which has strengthened as investors anticipate the Federal Reserve may change its approach to interest rates.

The CPI data showed headline inflation at an annual increase of 2.6% and core inflation steady at 3.3%, leading traders to rethink their expectations for possible interest rate cuts. As a result, fewer investors expect rate cuts in December. Additionally, gold Exchange Traded Funds (ETFs) have seen significant outflows, and demand for gold may decline due to an economic slowdown in China. Analysts note that if gold prices remain below $2,600, they could drop further toward $2,500 per ounce.

According to the CME Fed watch tool, the probability of a 25 basis points rate cut in December increased to 82.50% from 58.70% a day ago.

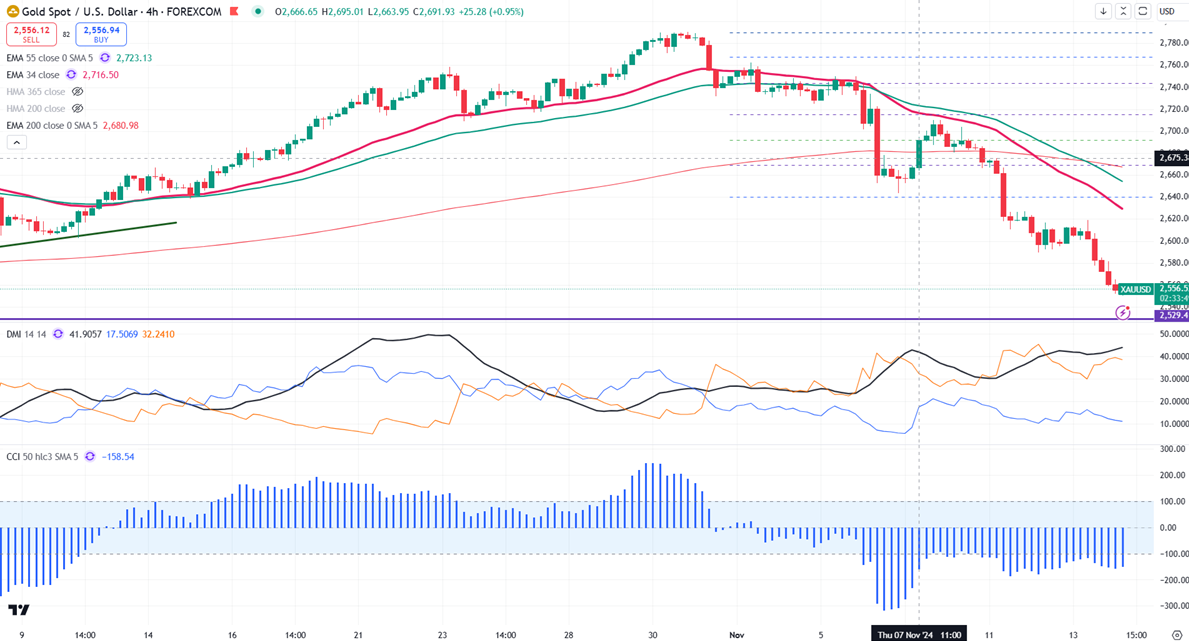

Gold remains below both short-term and long-term moving averages on the 4-hour chart. The immediate support level is around $2,550; a fall below this could lead to targets of $2540/$2500/$2470. A bearish trend would only be confirmed if prices drop below $2,470. On the upper side, minor resistance is found at $2,620, and breaking past this barrier could push prices up to $2635/$2665/$2700.

Current market indicators present a bearish outlook: the Commodity Channel Index (CCI) indicates a bearish trend, while the Average Directional Movement Index (ADX) suggests a neutral outlook.

Consider making sell on rallies around the 2578-80 mark, with a stop-loss positioned around 2,600 and a target price of $2475.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?