Market Overview: Gold Prices Under Pressure

Gold prices are weak because the US dollar is strong, and US Treasury yields are going up. Gold recently dropped to a low of $2,643 but is now around $2,669.

2. U.S. Economic Data: Job Market Improvements and Consumer Concerns

Initial jobless claims dropped to 216,000, down from 221,000 last week and below the expected number of 221,000. This shows a small improvement in the job market, as fewer people are applying for unemployment benefits. On the other hand, the preliminary Michigan Consumer Sentiment index fell to 70.5 from 71, which might mean that people are worried about inflation and the economy.

3. Political Impacts on Monetary Policy: Trump’s Re-election and Inflation Risks

Trump's re-election could make it harder for the Federal Reserve (the Fed) to manage its monetary policies. Some of his proposed policies, like tax cuts, more government spending, and tariffs, might lead to an increase in inflation by up to 1 percentage point according to some economists. If inflation goes up a lot, the Fed may have to change its current approach and might need to raise interest rates instead of lowering them.

4. Fed Rate Cut Expectations: Shifting Probabilities

According to the CME Fed watch tool, the probability of a 25 basis points rate cut in December decreased to 64.90% from 79.60% a week ago.

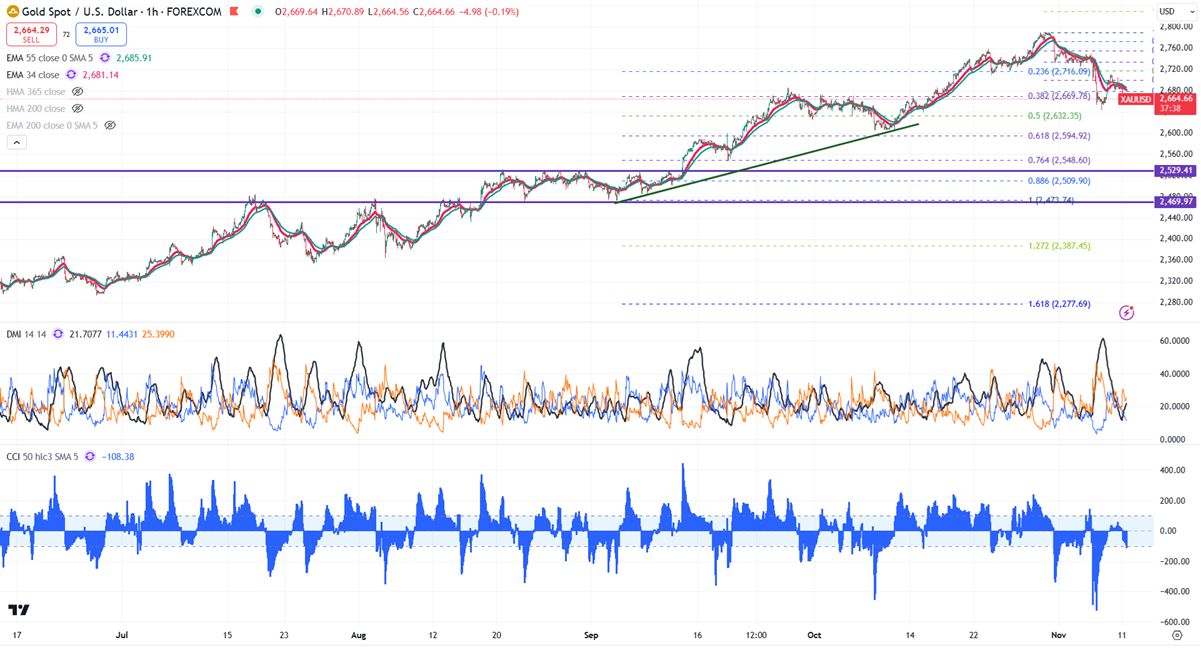

5. Technical Analysis: Gold’s Breakdown and Trading Levels

Gold remains below both short-term and long-term moving averages on the 4-hour chart. The immediate support level is around $2,650; a fall below this could lead to targets of 2,632/2,632/2,600/$2,590. A bearish trend would only be confirmed if prices drop below $2,470. On the upper side, minor resistance is found at $2,720, and breaking past this barrier could push prices up to 2,735/2,735/2,760/$2,775.

Current market indicators present a bearish outlook: the Commodity Channel Index (CCI) indicates a bearish trend, while the Average Directional Movement Index (ADX) suggests a neutral outlook.

Consider making sell on rallies around the 2,700 mark, with a stop-loss positioned around 2,730 and a target price of $2,600.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary