The yellow metal traded higher on Tuesday, as European shares fell and inflows into bullion funds increased boosting metals prices. The commodity rebounded strongly after finding support at 1206 in the early European session, and currently is approaching to test resistance level located at 1234.

- Any downside is expected to be limited around 1210 levels as the support level located at 1206 is likely to hold the bears from falling further below and bring a rebound back towards higher levels.

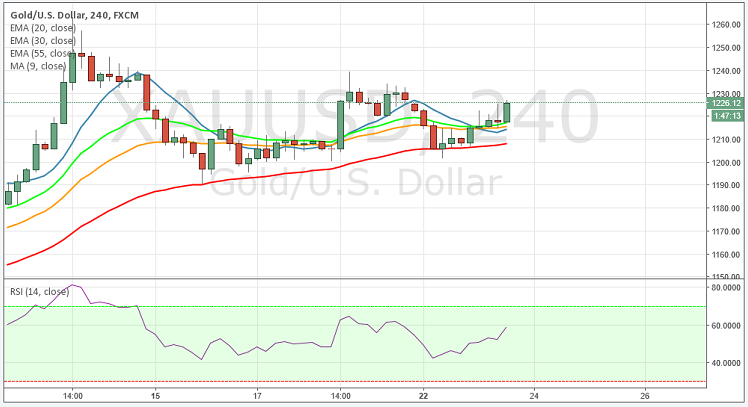

- Technically in the 1 hour chart the 55, 30 and 20 MA slowly turning up, whistle the RSI is in positive territory at 58.

- To the upside, the strong resistance can be seen 1234, a break above this level would expose the commodity towards 1254 levels.

- To the downside immediate support can be seen at 1218, a break below at this level will open the door towards 1206 levels.

Recommendation: Go long around 1210, targets around 1235/1260, SL 1198

Support levels: S1-1218, S2-1206, S3-1198

Resistance levels: R1-1234, R2-1254, R3-1270