Gold's massive fall since 2011, has flown investors out of the gold market, however latest demand analysis from world gold council (WGC) shows Gold is gaining back some of its investment appeal in 2015.

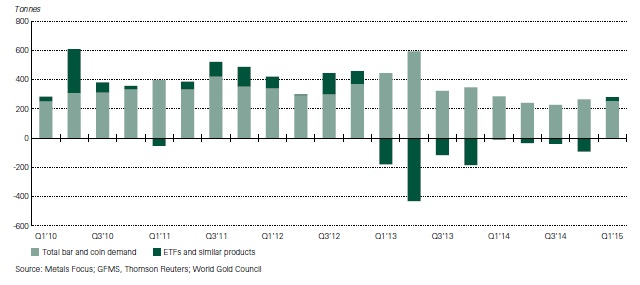

- Latest WGC statistics show net investments in Gold ETF turned positive in the first quarter of 2015 for the first time since fourth quarter of 2012. Asset under management grew 26 tons. US accounted for most of the demand, however money flew to UK and US listed ETFs. The chart from WGC shows net demand for Gold ETFs and bars and coins. Demand for gold bar and coins demand was down -10% y/y, however still remains at elevated at 253 tons, well above average demand of 100 tons between 2005 and 2007.

Inflationary fear and uncertainty over Federal rate hike might be pushing investors toward gold this year.

Gold is trading around $1215/troy ounce, it curved high above resistance area of $1224, however failed to hold on to its gain. Gold is most likely to test and break the resistance. Target of gold is around $1252, should dollar weaken further.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand