After years of economic turmoil, Euro zone growth is returning across region boosted by European Central Bank's (ECB) ultra-loose monetary policies. As of now, ECB is purchasing € 60 billion worth of securities per month.

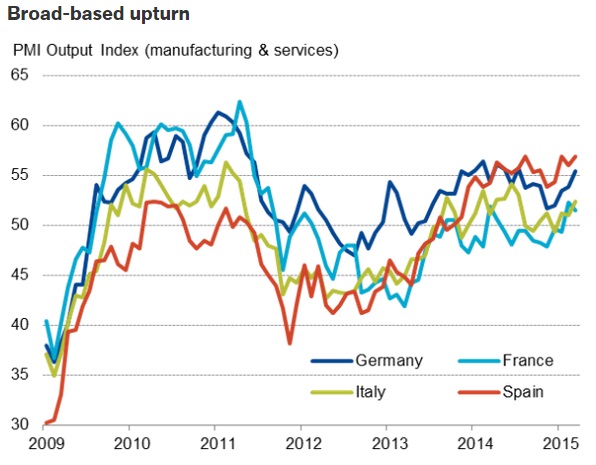

Services sector in Euro zone continue to pose strength. PMI above 50 indicated growth and below contraction.

- Spanish services PMI registered 57.3, up from flash 56.2.

- Italy services PMI up from flash 50 to 51.6

- France register 52.4 in services PMI, however fell from flash 52.8

- Germany services PMI registered 55.4, up from flash 54.3

However Euro zone services grew at faster pace in March with PMI at 54.2, compared to 53.3 in February.

- Manufacturing production in Euro zone rose at fastest pace in 11 months.

- Employment rising at fastest pace in at least 36 months across region.

- Growth in new businesses is hitting four year record.

However growth still remains diverge across region. Comparing larger economies Italy and France are lagging well behind Germany and Spain.

It is further dismal when compared between Greece and Ireland.

There is no doubt that weaker Euro and Strong investor and consumer sentiment is benefiting the region but structural issues like TARGET 2 imbalance requires to be solved.

- Sentix investor confidence rose to 20 from prior 18.6

- Producer price index rose 0.5% in February as input cost rose over weaker Euro.

Euro is down against dollar, trading at 1.085, in spite of positive data. European stocks are looking to be attractive investments as the companies will be the major beneficiary of these improvements.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings