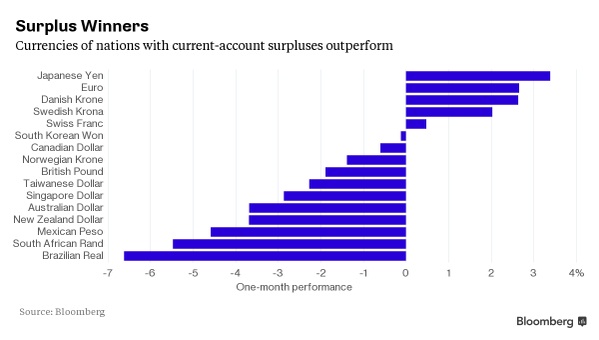

Latest analysis from Bloomberg shows that traders and investors' in latest financial market turmoil are preferring to perk their money to surplus currencies.

The chart shows, in past month alone Japanese Yen, a significant current account surplus economy, rose more than 10% against Brazilian Real, a significant deficit economy.

Taper tantrum of 2013, showed similar trend, when investors refused to finance emerging economies' large current account and fiscal account deficit, pushing currencies lower across emerging markets.

In the past one of the FxWirePro report from us showed how fundamental strategies are working best since post crisis and we expect that old book's such as buy surplus, sell deficit are likely to perform well over the next couple of quarters.

- In spite of European Central Bank's massive quantitative easing, which is pushing Euro down against all most all currencies remains a buy due to its large current account surplus and reforms to manage it fiscal deficit going ahead.

- Weaker Euro is improving the odds of better recovery across Euro zone.

In spite of China's large current account surplus, it is not likely to benefit from haven flows as the outlook going ahead is much weaker.

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight  Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play

Why did Iran bomb Dubai? A Middle East expert explains the regional alliances at play  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target

Crude Oil on the Cusp: Hormuz Blockade Threats Fuel 15% Rally Toward USD 85 Target