Higher energy prices, coupled with a revival in investment spending pose potential risks to India’s current account deficits, enlarging possibilities of a widened deficit in the near term.

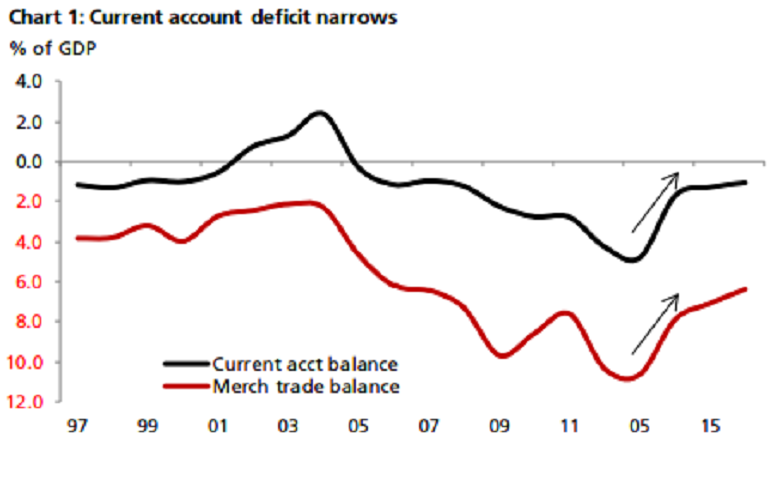

India has run current account deficits (CADs) since the early-1990s, except for a brief period in 2002-04. The deficit averaged 1-2.5 percent of gross domestic product (GDP) over most of the past decade before rising to 4 percent in FY12-13 on the back of a jump in oil imports and gold purchases. It has since fallen back to about 1 percent of GDP and is expected to remain about there for the foreseeable future, DBS reported.

India’s CAD narrowed to 1.7 percent of GDP during the fiscal year 2013-14, from a huge 4.8 percent same period a year ago. A smaller merchandise trade deficit, owing to fall in gold purchases led to the decline. The sharp fall in demand for the yellow metal was engineered through a host of trade and administrative curbs, leading to a sharp 70 percent dive in the metal’s imports in FY13-14. Global commodity prices were also softening, helping cap oil imports.

At the present scenario, the current account has largely benefited from a fall in imports rather than greater exports. The sharp drop in crude prices cut the oil import bill by one-third, while subdued investment demand kept a lid on non-gold non-oil purchases. The latter fell 9.0 percent during Apr-Jul 2016 compared to -4.0 percent during FY15-16.

Amongst invisibles, service receipts and private transfers and/or remittances are also showing signs of strain. Thus the current improvement in the current account is not as favorable as the one in 2002-04. Against this backdrop, the CAD should narrow to 0.8-0.9 percent of GDP from 1.1 percent in FY15-16. A stronger current account balance would be at risk if crude prices hit above USD 60/bbl this year, DBS reported.

At the same time, a pickup in investment could also lift imports, putting renewed pressure on the current account. If these risks materialize, a return to the long-term deficit range of 1.5-2.0 percent of GDP would likely follow. While the size of the current account is important, how it is financed is equally imperative.

"Given the government’s move to raise limits/ relax sector-specific regulations for FDI, undertake reforms to improve the ease of doing business and efforts to streamline the investment process, we expect foreign investment flows to improve in the coming years," DBS commented in its latest research report.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed