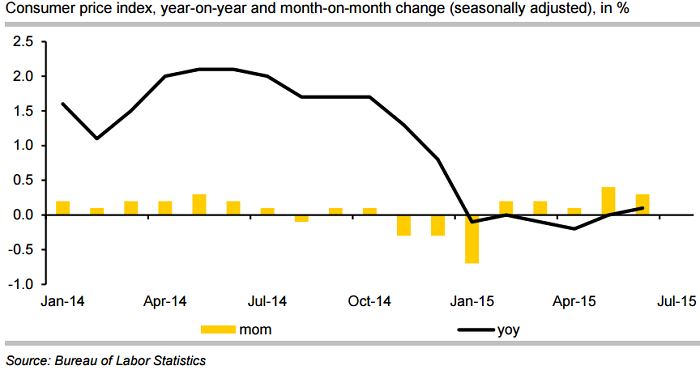

US CPI and the FOMC Minutes are the main macro highlights heading into NY Session today. Will US CPI data for July due later in the day support USD, just like the upside surprise in UK inflation propped up the pound sterling yesterday? A positive surprise would certainly have an effect on the USD exchange rates.

In the short run, however, inflation is likely to have a less direct impact on monetary policy in the US than in the UK. The Bank of England (BoE) has credibly communicated to markets that rates will not be hiked until a steady uptrend in inflation has emerged. Things are quite different for the Fed.

An increase in core price inflation or wage inflation is not a prerequisite for lift-off in Fed rates, according to Fed Chair Yellen. In its July statement, the Fed no longer said that commodity prices had stabilized. Some market participants thought this was a sign that the Fed is increasingly worried about the inflation outlook. However, the Fed has linked the timing of the first rate hike above all to a further improvement in the labour market.

Dennis Lockhart, the Atlanta Fed Governor, had explained in a widely noticed interview why the Fed pays so much attention to the labour market: While the inflation picture will probably remain diffuse in the coming months, growth is robust and the labour market is doing very well. Therefore, it makes sense to hike rates before inflation accelerates palpably.

As for the FOMC Minutes, there is not much hope that the minutes will magically clear the fog surrounding Fed policy and resolve the debate raging in the market. Minutes are unlikely to yield much in the way of direct guidance on a September start to tightening, but markets will be looking closely at more on tightening mechanics.

"Perhaps the minutes will finally make the market realize that the Fed's baseline scenario foresees a rate hike in September and that only massive downside surprises will keep the Fed from implementing its plans. Judging from the Fed's signals up to now, however, inflation is unlikely to be the tipping factor", said Commerzbank in a research note to its clients on Wednesday.

Traders remain in a wait-and-see-mode ahead of crucial data. USD/JPY trades trades modestly flat at 124.32, while EUR/USD gains were capped at 1.1071. GBP/USD rejected at 1.57 handle, trimmed gains to trade at 1.5661.

How does inflation influence U.K. and U.S. monetary policy?

Wednesday, August 19, 2015 12:14 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings