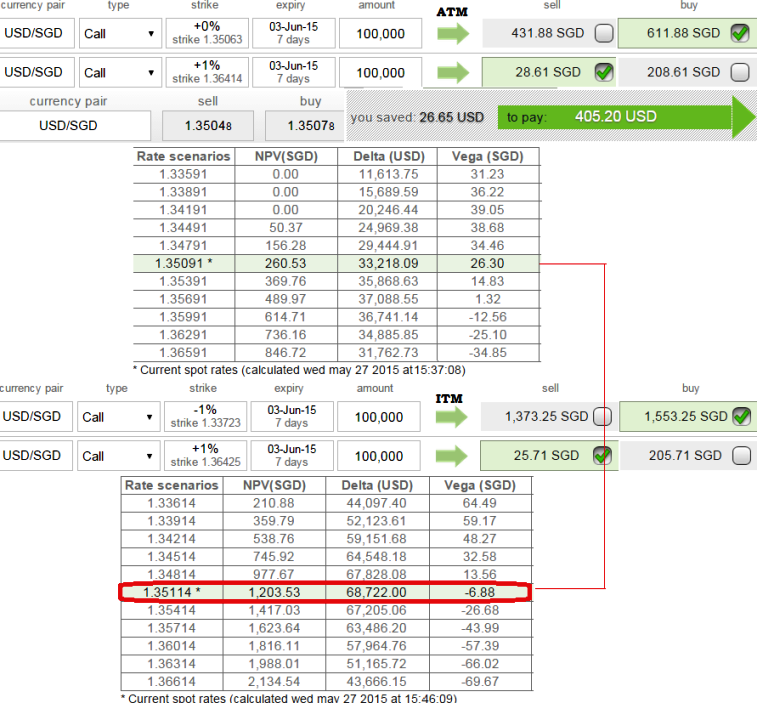

Currency Option basket: Debit Call Spread

Overview: Bullish

Although this strategy seems a bit expensive but still profitable scheme as the NPV of this strategy does not suggest right option premium. Risky traders can deploy this for potential upswings on this pair.

Buy a Call (either ATM or ITM) and Sell another Call (OTM) with a higher Strike Price with the same expiration date for a net premium payable.

This is worth using a Bull Call Spread over a long call as the bull momentum are triggered and taken over by many bulls which leads the cost of the long naked call too expensive.

Credit from short call reduces the cost of long call.

The higher Theta embedded in short term options seems to be the reason for the outperformance approximately twice the amount of premium is collected.

Potential benefits of daily roll: Higher performance dispersion when rolling only once a week, Daily Rolls gives a statistical exposure by reducing the performance dispersion.

For a given maturity while buying a call, strategies based on ATM strike appear to deliver better risk-adjusted returns than ITM.

While shorting an option the Vega of a short position is negative with an increasing implied volatility is not favorable for the objective of this strategy.

At current levels, the strategy using ITM call carries negative Vega as shown in the picture (-6.88).

Ideal Risk/Reward Ratio on BCS of USD/SGD using ATM calls

Wednesday, May 27, 2015 10:31 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate