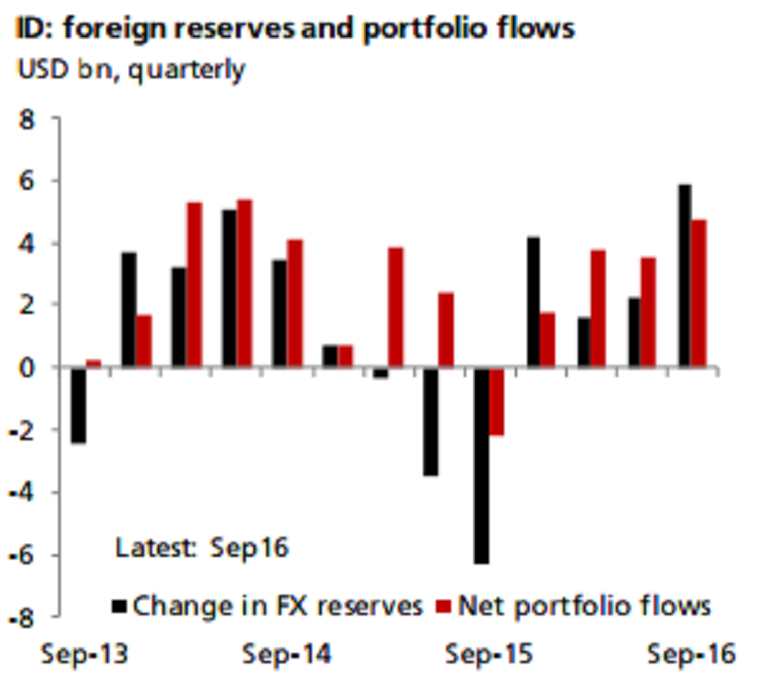

Foreign reserves in Indonesia surged to more than a four-year high during the month of September s having risen by close to USD10 billion. This is equal to about 80 percent of total foreign inflows recorded in equities and Indonesian government bonds.

Bank Indonesia (BI) officials have reiterated that the central bank prefers to avoid excessive rupiah strength. Going by the foreign reserves number, it is clear that the central bank has been active smoothing flows in the markets.

Moreover, building up reserves is also important to shore up the macro risk profile, amid lingering uncertainties in global markets. Admittedly, risk of a selloff similar to the mid-2013 episode is no longer as significant now that markets are increasingly getting used to the idea of an eventual and gradual tightening by the Fed, DBS reported.

Still, Indonesia’s external liquidity front remains among the most vulnerable in the region. While current account (C/A) deficit has narrowed to about 2 percent of the country’s gross domestic product (GDP), net foreign direct investment has also moderated to about 1.2 percent of GDP. Portfolio flows still finance quite a big chunk of the C/A deficit.

It is important to note, however, that BI is no longer tolerant of a weak rupiah (relative to its regional peers). This previous stance never quite made sense, given that the economy is a price-taker for most commodities, which are important for the overall export growth. Besides, the real challenge to prop up GDP growth now is the weaker-than-expected private investment growth. Arguably, with significant import content in the economy, a stronger rupiah could even boost growth momentum ahead, the report added.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns