Rising inflation expectation around globe is warning investors of the coming reflationary environments. It seems that deflationary cloud over global economy is finally fading and investor are increasingly worrying about upcoming inflation.

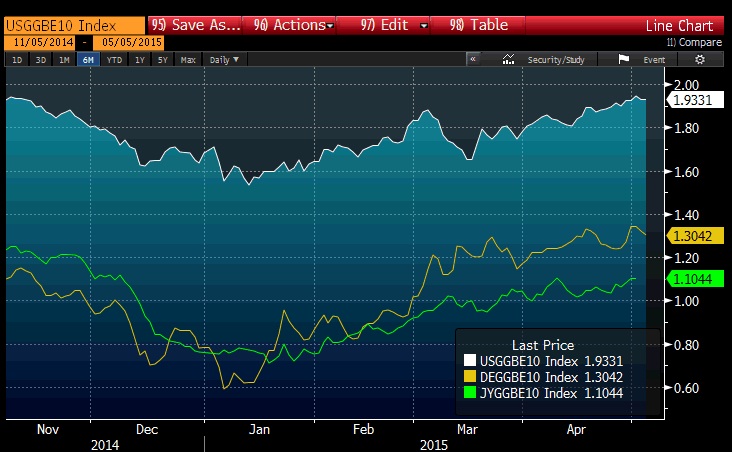

The above chart from Marc Chandler shows, the rising trend of inflation expectation as measure by 10 year break even rate.

- US 10 year break even rate have risen from 1.5% in January to 1.65% by March and 1.95% as of now.

- Japanese 10 year break even have risen from 0.7% in January to 1% by March and 1.1% as of now.

- Similarly German 10 year break even rate have risen from 0.59% in January to 1.3% as of now.

This rise of market based inflation expectation now started reflecting in rising bond yields across globe though initially it was ignored mostly.

What might be fuelling expectation rise?

- Rising growth expectations especially from Euro zone is one of the key factor of this rise. Deflationary fear was highest in Euro zone.

- Lower crude oil price since last year has been a hindrance to inflation, however crude has risen close to 30% from recent bottom. Other commodity prices have also followed suit. Broad based CRB index has appreciated 12% from bottom.

- Evidence suggest that labor cost will be rising more rapidly over coming days.

Rising inflation will not be good news for bonds, as yields are still hovering at record lows.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings