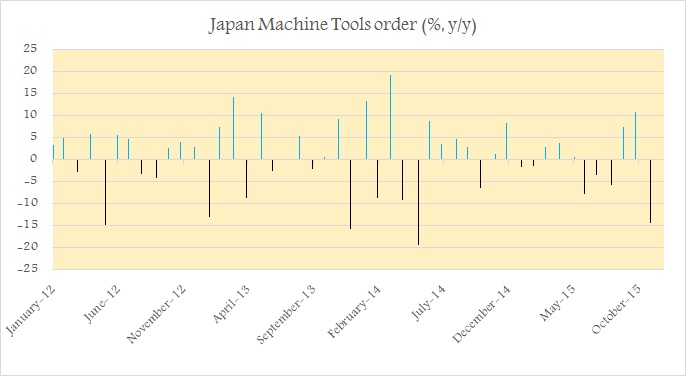

Abenomics, which is set of policies introduced in Japan, which includes ambitions such as bringing inflation back in Japan, increase sales tax to balance budget might be losing its charm, at least November's Machine tools orders, which is synonymous to capital expenditure in Japan, would say so.

In November, Japanese Machinery orders recorded, sixth decline for the year. Though the data is usually volatile and moves on both side of zero, regularly, a double digit decline is relatively rare. November's 14.4% decline is biggest since May, 2014 and third double digit decline in last five years or more.

Machinery orders till November has declined in six of the 11 months and drop has been much more frequent and large since 2014, posing considerable doubts on Abenomics' ability to boost back growth.

On the other hand, despite Bank of Japan's (BOJ) sincerest efforts and purchase of ¥80 trillion assets per annum falling far short of boosting inflation. Consumers have cut back on purchases in response to higher price.

According to last night's data, corporate goods price dropped -0.3% in December, down -3.4% from a year ago.

Nikkei dropped sharply in response to bad data, at once point was down as much as 4%, while Yen is relatively strong, trading at 117.8 per Dollar.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off