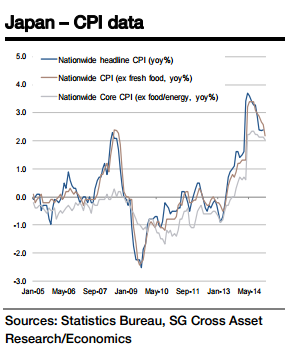

Japan's nationwide CPI (excluding fresh food) is expected rise 2.1% yoy in February (was 2.2% in January). Excluding the effects of the consumption tax (CT) hike, the pace of inflation is easing and is likely to be 0.1% yoy in February, implying that inflationary pressure has virtually dried up.

On a seasonally adjusted basis, inflation remained at 0.0% mom for three consecutive months between October and December. This indicates that inflationary pressure has been well balanced because the upward pressure on prices due to yen depreciation and recovering domestic demand has been cancelled out by downward pressure from the fall in oil prices. However, the level fell to -0.3% mom in January, implying that the downward pressure from falling oil prices is now stronger.

Societe Generale says the CPI to temporarily move below 0.0% yoy by mid-2015. The BoJ has continued to change its wording to explain its CPI outlook, revising it from "around 1.25%", to "around 1.0%", and then to "CPI is likely to slow for the time being".

After the March BoJ meeting, it was further revised down to "about 0% for the time being". Given that the decline in energy prices should have a positive effect on economic growth, any further weakness in CPI due to a fall in oil prices is unlikely to trigger immediate additional QQE.

"We predict that by Q3, inflation is likely to accelerate again thanks to the stabilisation of oil prices and upward pressure on prices due to wage increases", added Societe Generale.

The BoJ will most likely wait patiently until then. However, by the end of October when the BoJ publishes a new semi-annual inflation and growth outlook report, we are likely to get confirmation of a weak pickup in CPI. In such a scenario, the 2% price stability target is unlikely to be achieved in the short term, and additional QQE is likely to be implemented.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed